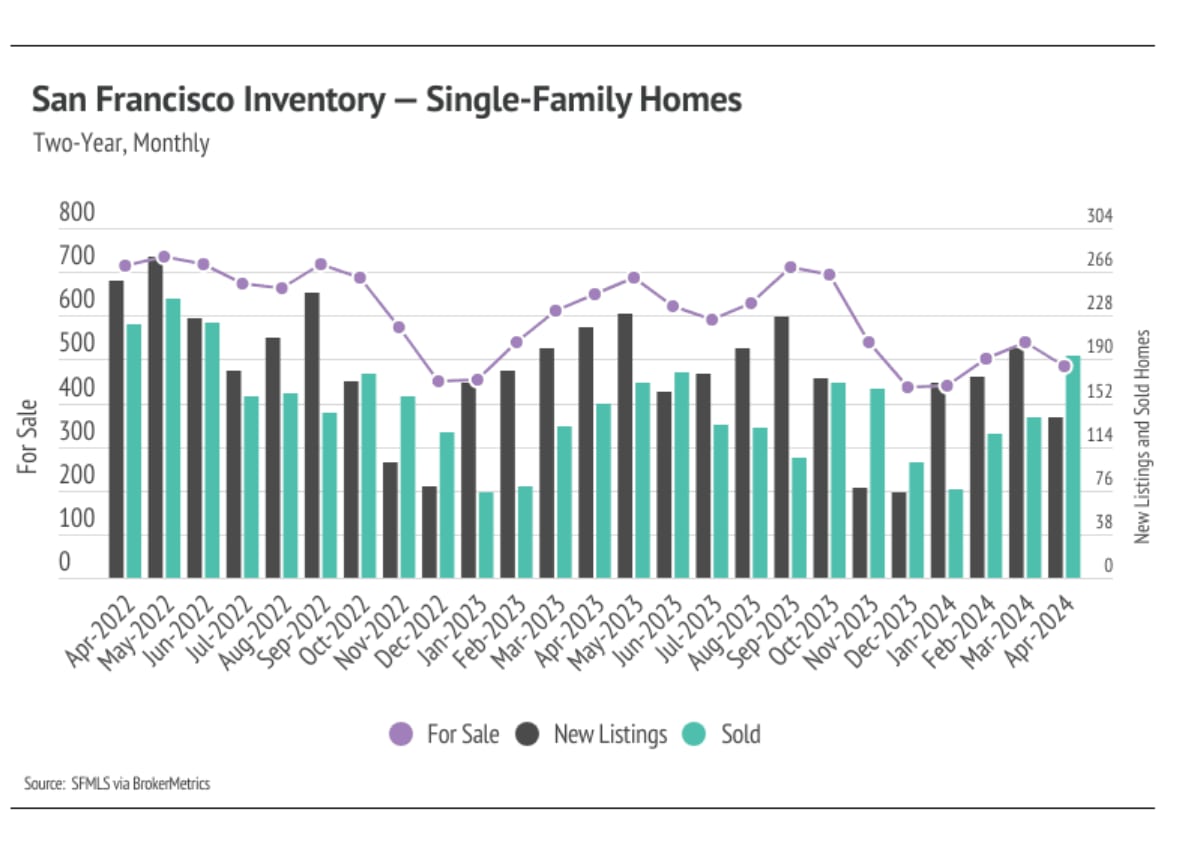

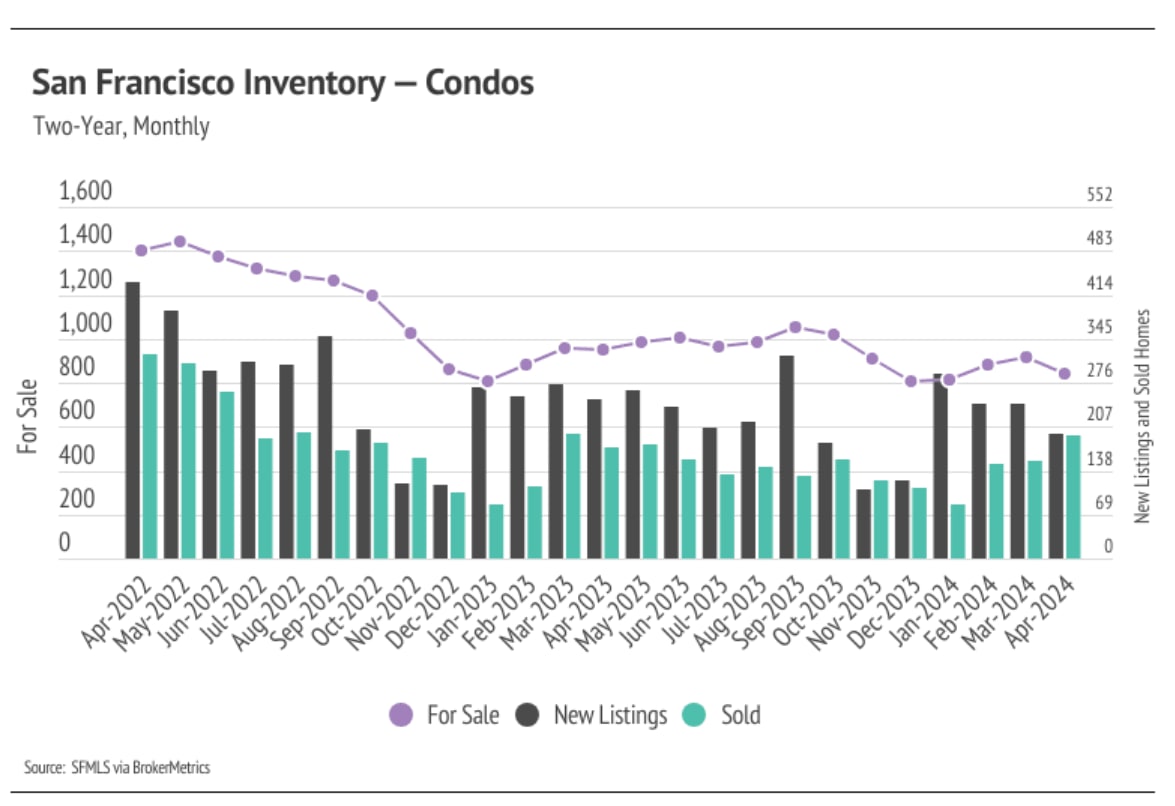

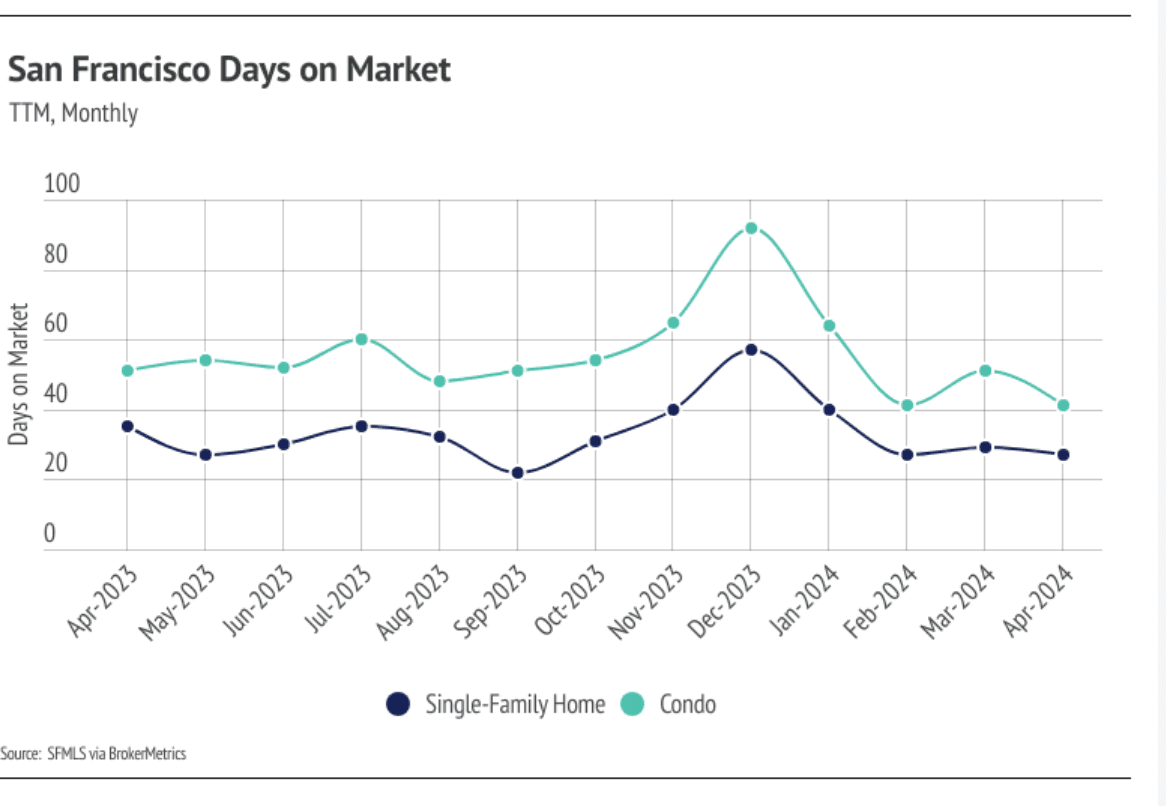

Since the start of 2023, single-family home inventory has followed fairly typical seasonal trends, but at a significantly depressed level, while condo inventory has been in decline since May 2022. Low inventory and fewer new listings have slowed the market considerably. Typically, inventory peaks in July or August and declines through December or January, but the lack of new listings prevented meaningful inventory growth. Last year, sales peaked in May, while new listings and inventory peaked in September. New listings have been exceptionally low, so the little inventory growth throughout the year was driven by fewer sales. In November and December 2023, new listings dropped significantly without a proportional drop in sales, causing inventory to fall to an all-time low in December, which further highlights how unusual inventory patterns have been over the past year. However, new listings in January 2024 rose 134% month over month.

The number of new listings coming to market is a significant predictor of sales, and the new listings in January led to a 68% sales increase in February. Both inventory and new listings declined from March to April, but sales rose considerably, up 33%. Year over year, inventory is down 16% and new listings are down 25%, but sales are up 20%. Demand is clearly coming back to San Francisco, but more supply is needed for a healthier market.

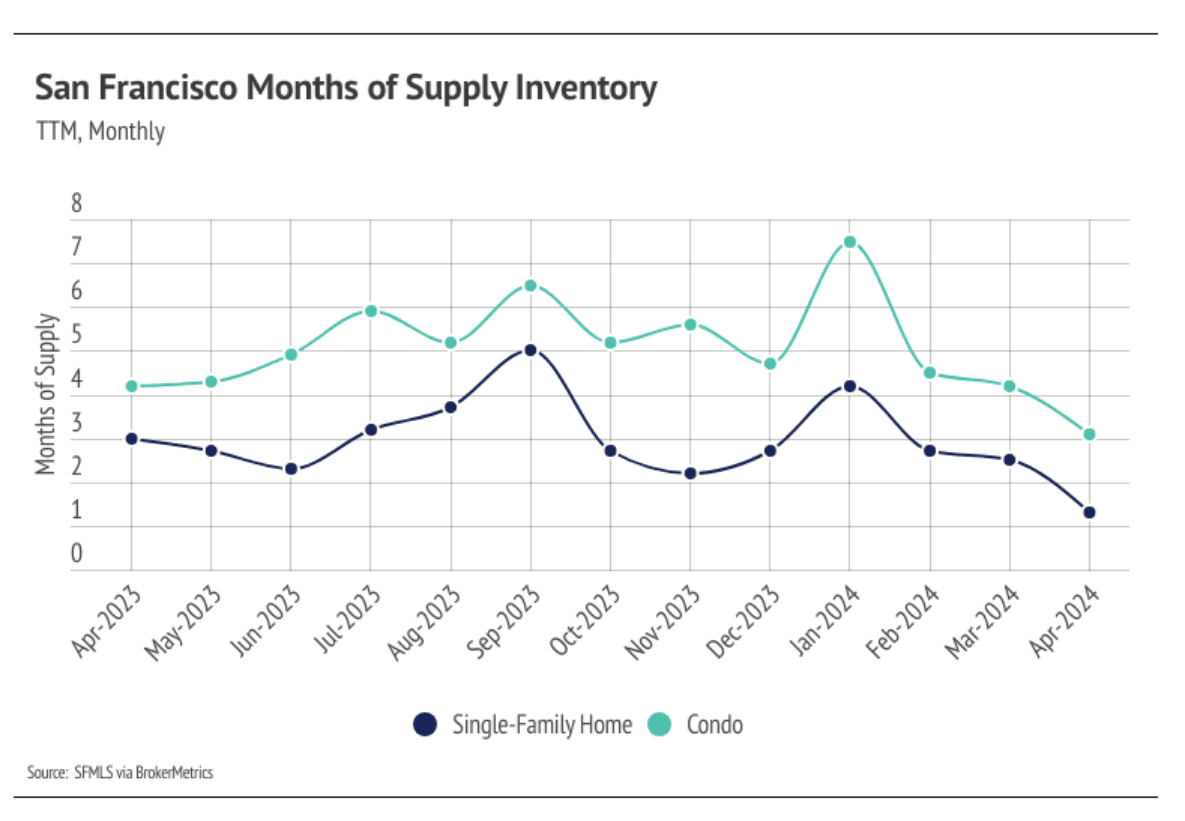

Months of Supply Inventory in March 2024 indicated a sellers’ market for single-family homes

Months of Supply Inventory (MSI) quantifies the supply/demand relationship by measuring how many months it would take for all current homes listed on the market to sell at the current rate of sales. The long-term average MSI is around three months in California, which indicates a balanced market. An MSI lower than three indicates that there are more buyers than sellers on the market (meaning it’s a sellers’ market), while a higher MSI indicates there are more sellers than buyers (meaning it’s a buyers’ market). The San Francisco market tends to favor sellers, at least for single-family homes, which is reflected in its low MSI. However, we’ve seen over the past 12 months that this isn’t always the case. MSI has been volatile, moving between a buyers’ and sellers’ market throughout the year. From January to April, MSI declined significantly, indicating that single-family homes shifted from balanced to favoring sellers, and condos moved from favoring buyers to balanced.

Local Lowdown Data