South Bay & Peninsula Real Estate Market Report: November 2020

michelle October 29, 2020

michelle October 29, 2020

Welcome to our November newsletter. This month, we discuss the state of the economy, COVID-19, and potential economic stimulus. We will also look at forecasts for the housing market now that we are entering autumn. Overall, the housing market has shown significant price growth over the second quarter, showcasing the strength and stability of residential real estate. Year-over-year sales have also increased considerably through the summer months. As we enter autumn, we believe the housing market is positioned for continued growth in both sales and price appreciation. As the market changes, we will continue to provide the most up-to-date housing information to support your buying and selling decisions.

In this month’s newsletter, we cover the following:

The Labor Department reported that employers added 661,000 new jobs in September, which is fewer than half the jobs added in August and about a third of those added in July. This trend indicates a slowdown in hiring. If the hiring rate remains at current levels, it will take 16 months to recover the jobs lost in March and April; however, it will take even longer if the hiring rate continues to slow.

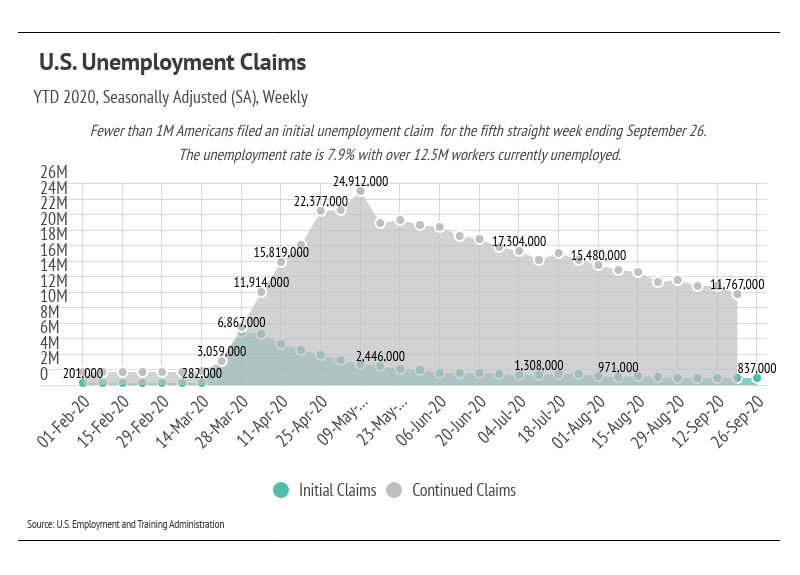

As of September 26, 12.5 million workers remained unemployed—an unemployment rate of 7.9%. More than 800,000 newly unemployed workers are filing initial unemployment claims each week, and 11.8 million are continuing to collect unemployment (see figure below).

Despite high rates of unemployment and an economic downturn, housing has held onto its value, particularly in the San Francisco Bay Area. Pandemic-induced economic impacts disproportionately affect workers without college degrees—individuals who were likely not in the housing market in the first place. And, as the Bay Area employs a high number of skilled workers with college degrees, its unemployment rate is lower than other areas of the United States, and its housing market is holding strong. Now, more than ever, the more highly skilled and educated a person is, the more likely they will be able to afford a home.

As we enter autumn, we are uncertain whether or not federal stimulus aid for individuals and businesses affected by COVID will come before or after the election. The immediate risks to the housing market, however, are fairly low. The Mortgage Bankers Association’s (MBA) Research Institute for Housing America (RIHA) reports that, for the most part, homeowners were able to continue their mortgage payments; however, renters struggled to pay rent. This should come as no surprise; only 6% of homeowners reported collecting unemployment by the end of June, while the percentage of renters collecting unemployment was more than double that.

Despite our struggling economy, the housing market has maintained its value, and homeowners have navigated this uncertain time well.

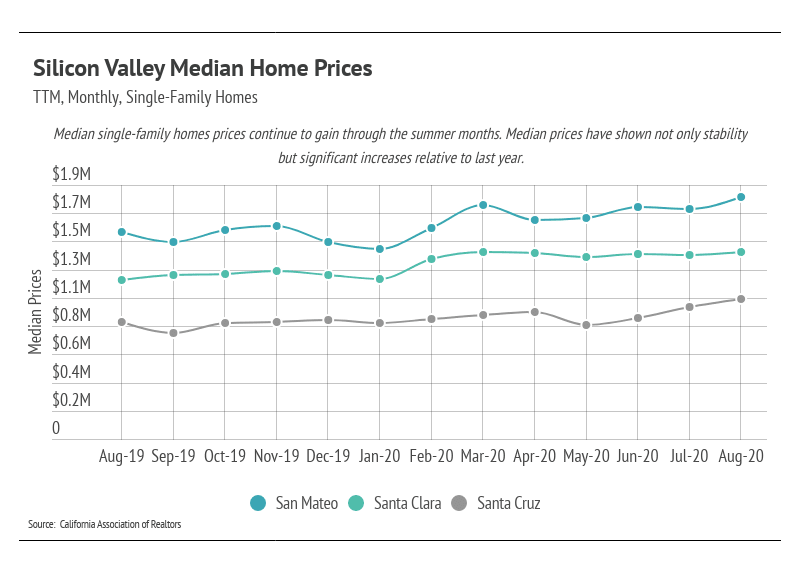

Single-family homes had the largest year-over-year gain of 2020 with a median home price of $1.8 million in San Mateo, $1.4 million in Santa Clara, and $1.05 million in Santa Cruz.

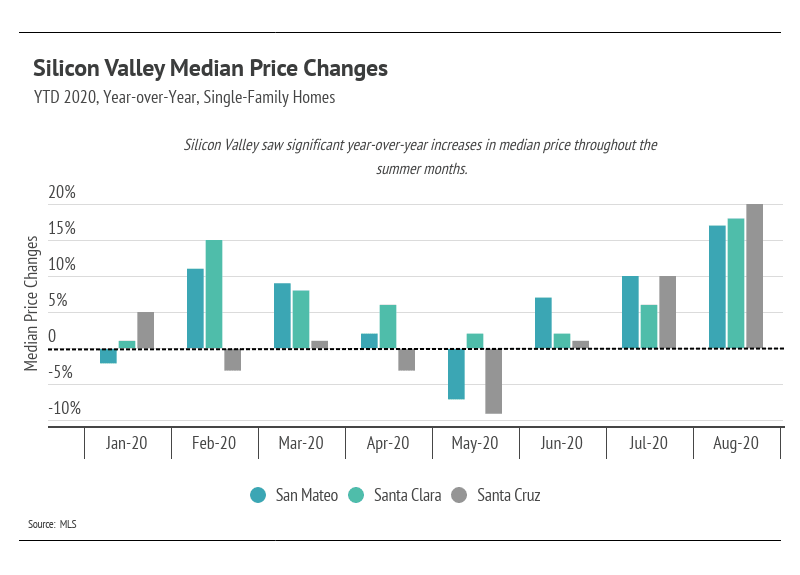

Year-over-year, median single-family home prices were up 17% in San Mateo, 18% in Santa Clara, and 20% in Santa Cruz.

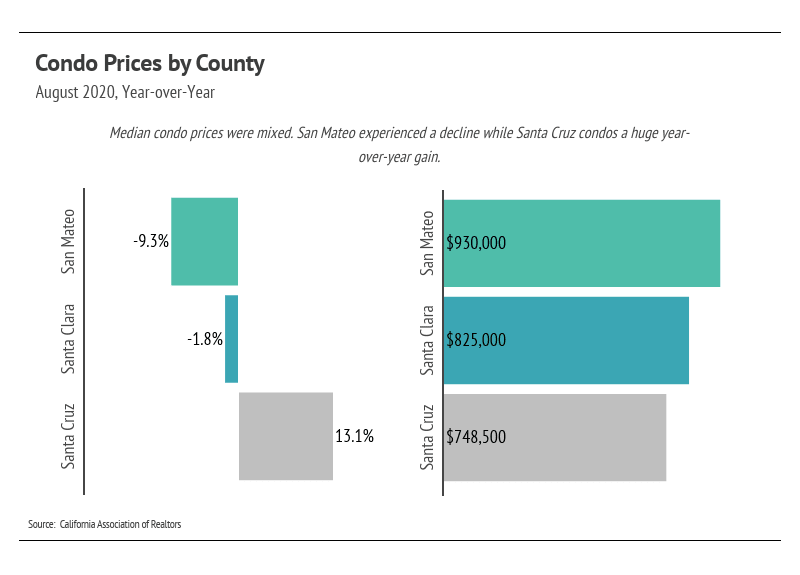

Median condo prices were mixed. Santa Cruz saw the most significant increase, up 13% year-over-year. San Mateo condos decreased by 9%.

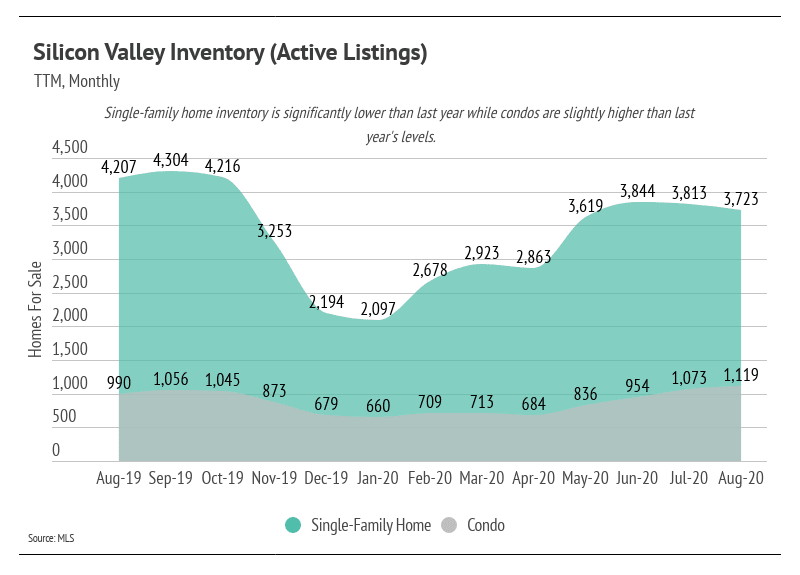

Total inventory decreased in August, as the number of homes under contract rose for both single-family homes and condos. Lack of supply compared to demand typically buoys Bay Area prices, and this is still the case for single-family homes, with more than 500 fewer homes for sale than this time last year.

The number of condos on the market, however, remains at a two-year high. The increase in condos for sale can be attributed to San Mateo specifically. We can tie the increase/decrease in condo prices to rises and falls in inventory. San Mateo condo inventory increased by 66%, which correlated to the 9% price decline. Santa Cruz inventory declined 13% and median prices jumped 13%. Santa Clara inventory was flat year-over-year. The large supply of condos in San Mateo has successfully given buyers a greater opportunity to find the right home for them, which we can see by the number of homes going under contract, up 24%. Even though more condos are on the market, we are seeing a large increase in purchases.

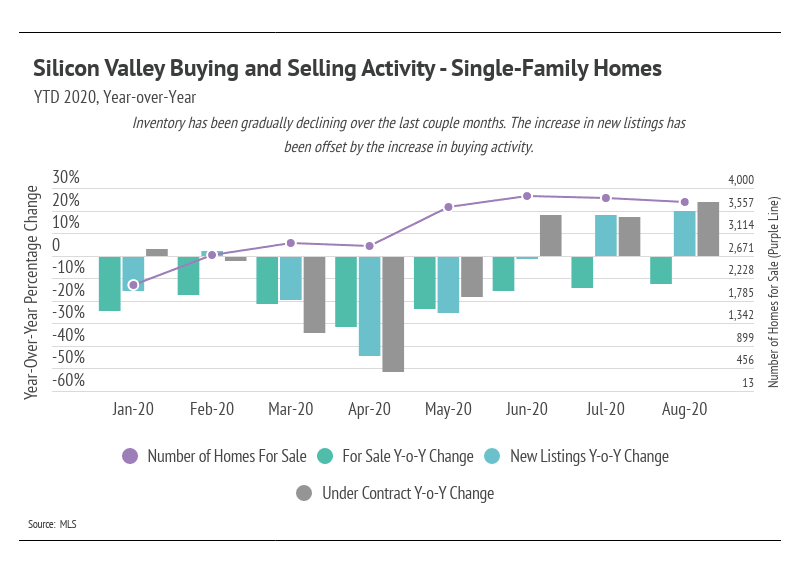

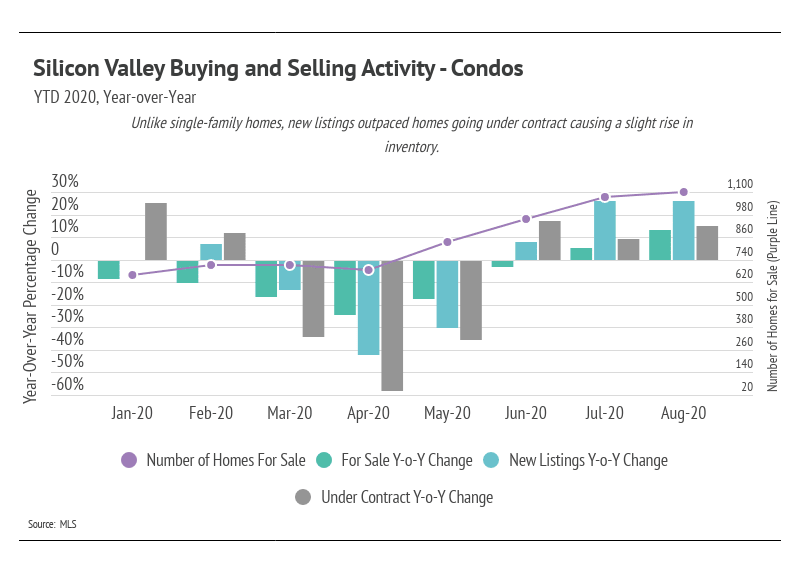

To understand buyer and seller sentiment, we can look at how new listings and homes under contract factor into the total inventory in a given month. Using 2019 as a normal year, relative to 2020, we can see the year-over-year abnormalities and seasonal changes.

During the initial months of the pandemic (March, April, and May), buyers and sellers hesitated to enter the market or withdrew from it entirely. Buyers of both single-family homes and condos mostly stayed out of the market from March through May, causing inventory to build.

New listings for single-family homes slightly increased in July and August, but were met with a dramatic increase in sales, causing a decrease in inventory. Condos were different in that new listings outpaced buyer demand in July and August, continuing the rise in inventory.

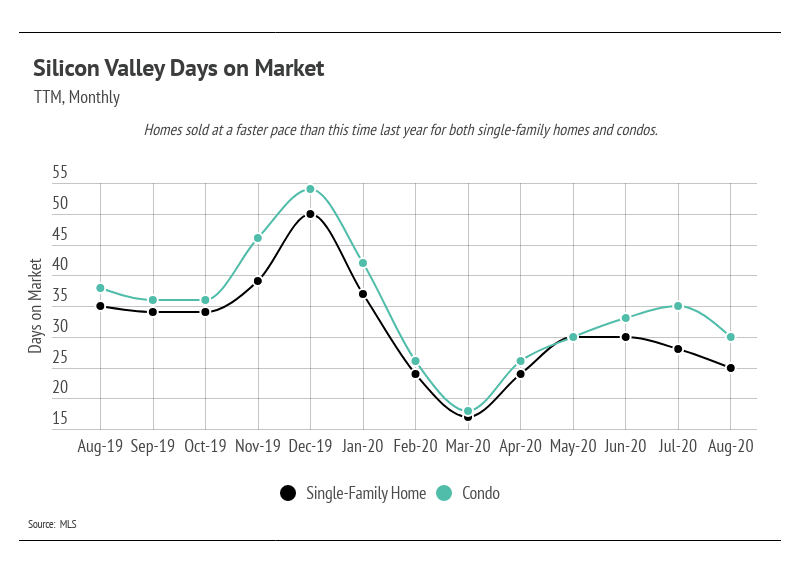

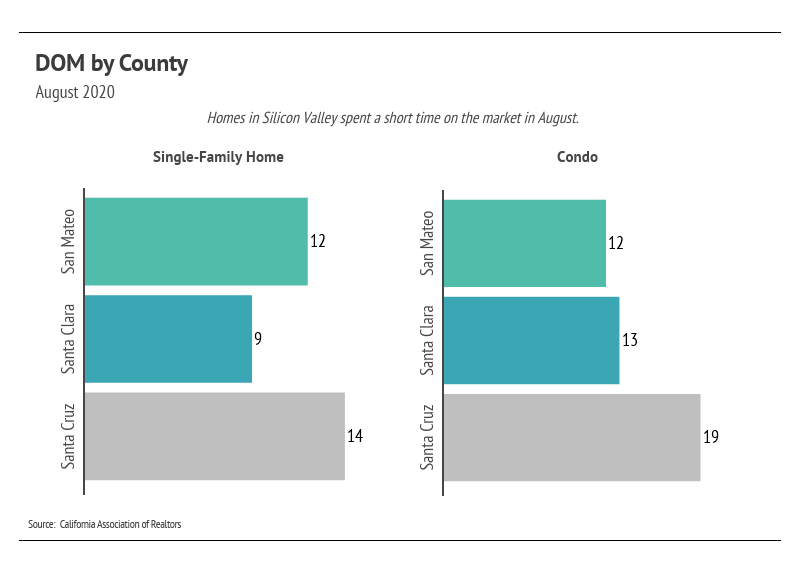

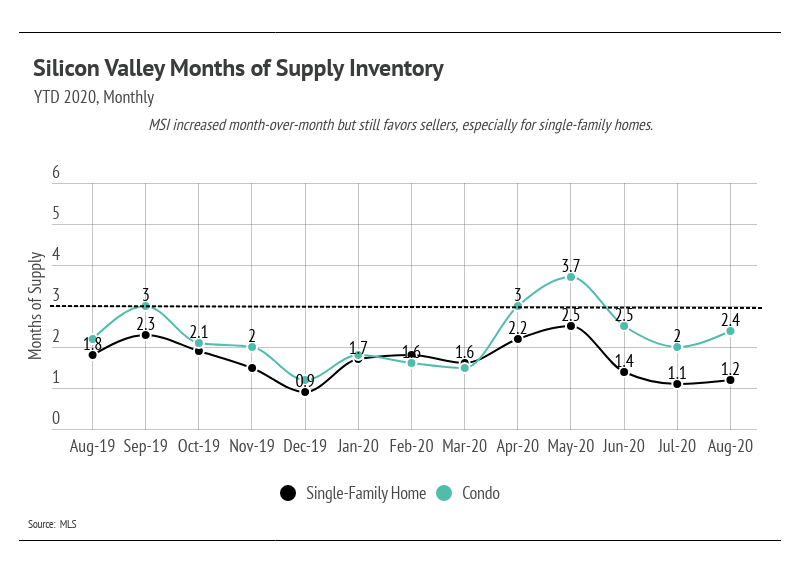

The Days on Market (DOM) trended down as buying activity increased. Single-family homes under contract were up 24% and contracts on condos up 15%, showing the high demand in the area. The pace of sales did not quite offset the increase in inventory, which caused the Months of Supply Inventory to rise slightly.

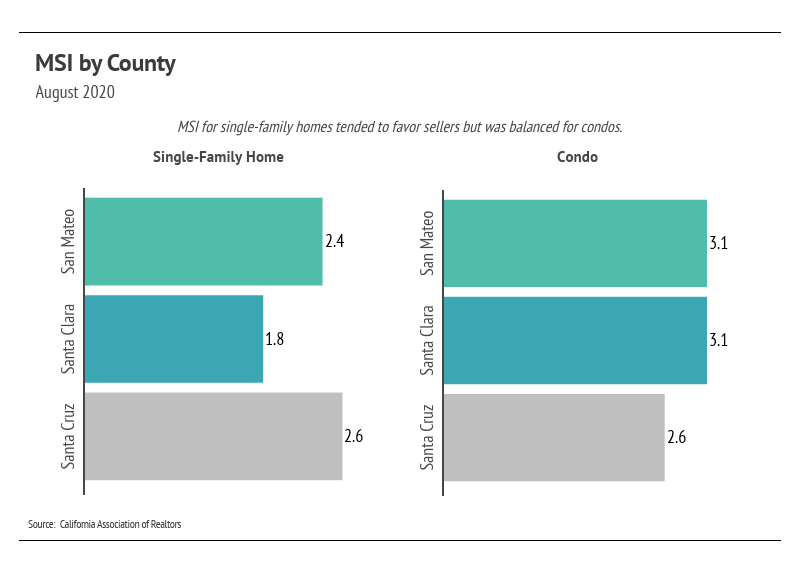

We can look to Months of Supply Inventory (MSI)—the measure of how many months it would take for all current homes for sale on the market to sell at the current rate of sales—as a metric to judge whether the market favors buyers or sellers. The average MSI is three months in California, which indicates a balanced market. An MSI lower than three means that buyers are dominating the market and there are relatively few sellers (a sellers’ market), while a higher MSI means there are more sellers than buyers (a buyers’ market). The MSI for single-family homes is typically below three, and an MSI of 1.2 is quite low, heavily favoring sellers. The MSI for condos is also below three, but closer to a balanced market with 2.4 months of supply.

In summary, the single-family home market in particular is heavily undersupplied, a byproduct of the desirability of Silicon Valley. Condo supply and demand was mixed across counties. Overall, the housing market has shown its resilience through the pandemic and remains one of the safest asset classes. As we digest seemingly endless stories on negative economic data, we are pleased to report that home ownership has offered a sense of stability.

Moving forward, we anticipate new condo listings to slow. Home prices will likely remain stable. The fall/winter season tends to see a slowdown in activity, as well, although this year we may see a new trend.

As always, we remain committed to helping our clients achieve their current and future real estate goals. Our team of experienced professionals are happy to discuss the information we have shared in this newsletter. We welcome you to contact us with any questions about the current market or to request an evaluation of your home or condo.

"*" indicates required fields

Stay up to date on the latest real estate trends.

Michelle Kim | February 24, 2026

Exploring Daly City housing trends, lifestyle benefits, and what makes this Bay Area community a practical choice for buyers.

February 6, 2026

A closer look at Pacific Heights real estate, lifestyle, and buyer considerations for the year ahead

Michelle Kim | February 1, 2026

Quick Take: As interest rates continue to fall, median monthly P&I payments do as well, making housing slowly but surely more affordable on a national scale. Mortgage … Read more

Michelle Kim | February 1, 2026

Quick Take: Median sale prices continued their upward trajectory in December, with single-family homes gaining 8.63% year-over-year. Inventory levels have plummeted to… Read more

Michelle Kim | February 1, 2026

Quick Take: Single-family home prices held relatively steady in December, while the condo market continued its year-long slide with double-digit declines in Alameda Co… Read more

Michelle Kim | February 1, 2026

Quick Take: Single-family median sale prices rebounded across most of Silicon Valley in December, with San Mateo County posting nearly 10% year-over-year gains. Invent… Read more

You’ve got questions and we can’t wait to answer them.