San Francisco Real Estate Market Report: May 2020

michelle May 4, 2020

michelle May 4, 2020

Welcome to our May 2020 market report for San Francisco. We hope you and your loved ones are safe and well. In this report, we provide important updates on how the global pandemic continues to impact the San Francisco housing market. This month’s topics include:

JP Morgan Chase was the first of the big banks to report that they are tightening their lending standards. Starting April 14th, borrowers applying for a mortgage with Chase will need a credit score of at least 700 and make a down payment of at least 20% of the home’s appraised value (this does not apply for existing mortgages or to low and moderate income borrowers who qualify for other loans). Although JP Morgan Chase does not disclose its mortgage lending standards, the Mortgage Bankers Association reports an average down payment of 10%. This change in standards could affect demand. In a market like San Francisco where a median single family home costs $1.7 million, the difference between a 10% down payment and a 20% down payment is $170,000. Even in the most affluent areas, $170,000 jump in immediate cash could price buyers out of the market.

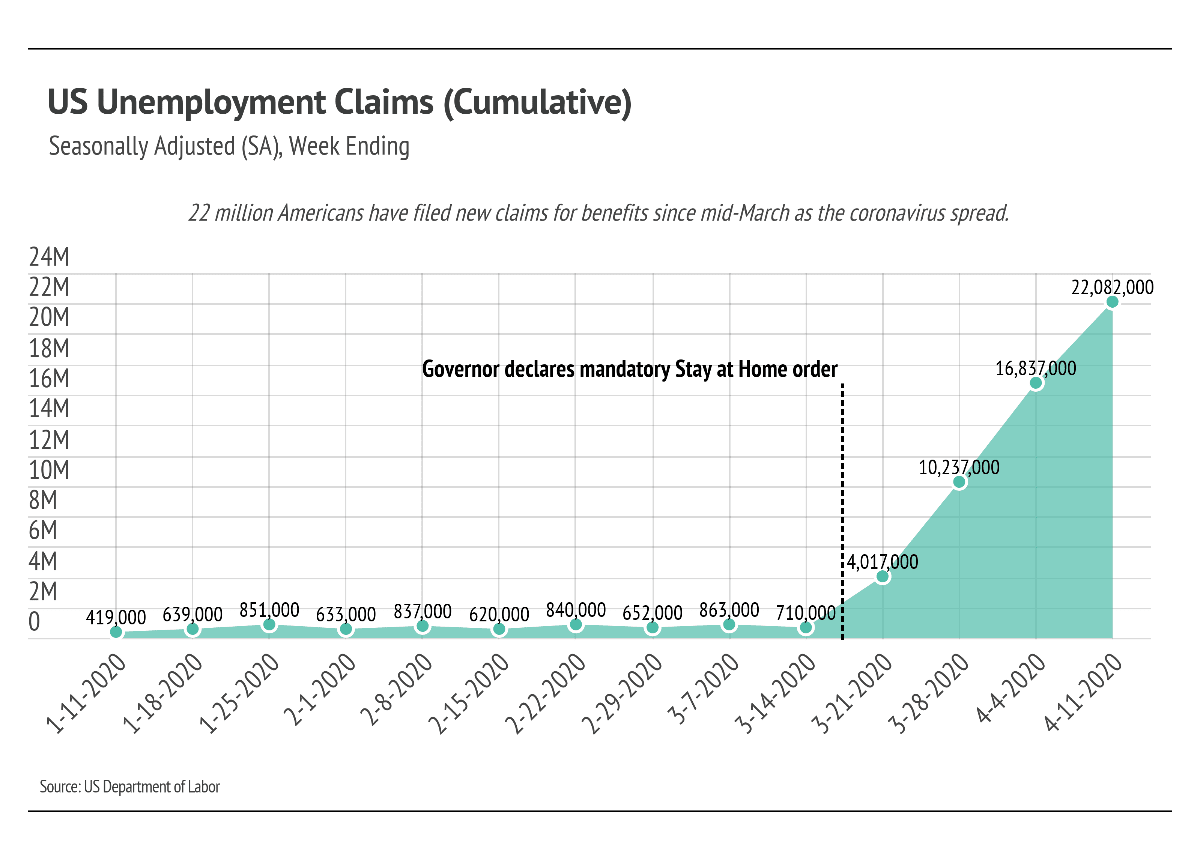

During the first week of April, unemployment claims in the United States reached record highs, near 17 million. While many Americans have already lost their jobs due to the shelter-in-place orders, a Federal Reserve estimate predicts the most difficult of the economic consequences are still ahead.

Economists at the Federal Reserve’s St. Louis District project total employment reductions of 47 million, which is a 32.1% unemployment rate, but they also predict the plunge to be short-lived. For perspective, the all-time highest rate of U.S. unemployment was 24.9% during the Great Depression in 1933. During that financial crisis, unemployment reached 10%.

Chief Economist of the California Association of Realtors, Leslie Appleton-Young, made the following statement on April 1st:

“I think there is going to be a bit of a price hit because the demand side is going to be hobbled by the shut down in the economy . . . but I don’t think it’s going to be big because supply is so constrained. The question is, are we going to see a flood of foreclosures on the market? I don’t think that is going to happen this year [because] when you look at what is happening in Washington, what is very clear is we know how to fight the war.”

In other words, as long as both supply and demand decrease at the same time, prices should not bottom out like they did in 2008 unless a large number of properties go into foreclosure.

To prevent that from happening, millions of homeowners, experiencing financial hardship, have requested mortgage forbearance. Forbearance is an agreement between a homeowner and their mortgage company to allow a reduction or delay in payments for a set time. Requests shot up by 1,270% between the weeks of March 2 and March 16, and by another 1,896% between the weeks of March 16 and the week of March 30, according to the Mortgage Bankers Association. The CARES Act, which went into law on March 27th, allows borrowers with loans backed by Fannie Mae, Freddie Mac, and Ginnie Mae to defer up to a year’s worth of monthly payments, which they are required to pay at a later date or in a payment plan. Mortgage forbearance, although not ideal, is far better than a wave of foreclosures. As Appleton-Young suggested, a spike in foreclosures will have a significant and lasting negative impact on residential real estate and the larger economy. Forbearance is one tool that can allow homeowners to remain in their home during a time period that would struggle with the economic and social impact of foreclosures.

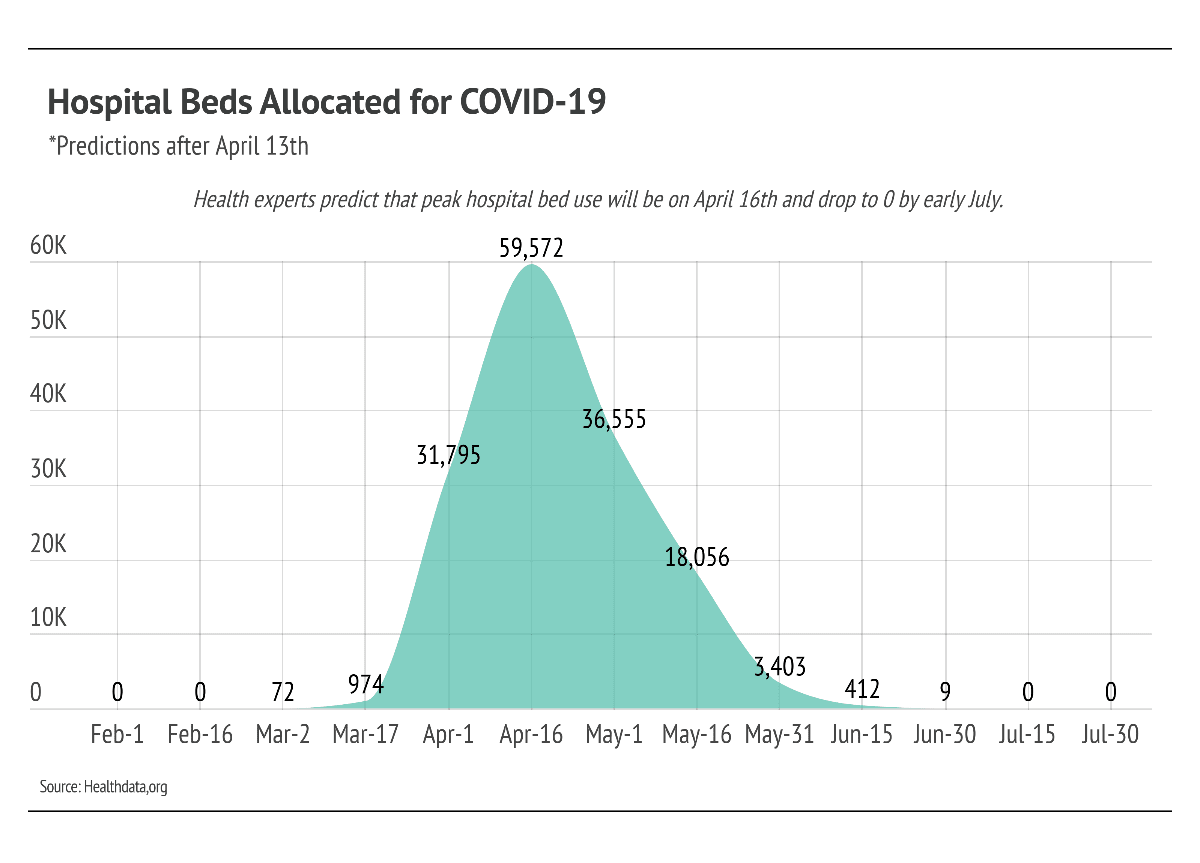

With all of the above dynamics playing out on a national and global stage, it’s fair to ask when we will see a semblance of normalcy. To answer this, we first look at the projected hospitalizations due to COVID-19.

April 10th marked the peak of hospitalizations due to COVID-19—four days earlier than expected. Health experts predict that peak COVID-19 hospital resources will drop to zero by mid-July, an encouraging trend indicating a reduction in the spread of the virus.

However, the return to normal life could take significantly more time as we are likely still a year away from a vaccine in the most optimistic scenario. Research has not conclusively shown that antibodies to COVID-19 imply immunity or the length of immunity. Although antibodies are often associated with immunity, the risk of reinfection could be too high to simply “re-open the economy” and go back to our pre-COVID-19 routines.

For many, if not most of us, we have spent more time in our home than ever before. With the understanding that this could go on for a year or two, we believe that the housing market could see some significant positive impact. The global population likely deeply desires a home that they love.

In her April 1st statement, Appleton-Young added the following:

“Going into [the pandemic] the housing sector was in a very, very strong position . . . The latest data that we had pre-virus was the February sales data. [They were] the strongest numbers that we had in two years . . . The underwriting is really good, the credit scores are good . . . But you have to to keep people in their houses, keep people whole, keep people on payroll, so there can be a quick turn around when the light turns green again.”

During the last week of March, St. Louis Federal Reserve President James Bullard said that while economic estimates are grim, “the plunge should be short-lived.” If this turns out to be true, we predict the market will slow significantly until restrictions ease, but home values will remain relatively stable.

Shelter is always a basic need. Life events—such as relocations, divorces, and deaths—still require people to buy or sell real estate. Real estate has been declared an essential service because everyone needs shelter, particularly in the time of social distancing. To that end, we remain committed to keeping you informed about local market conditions.

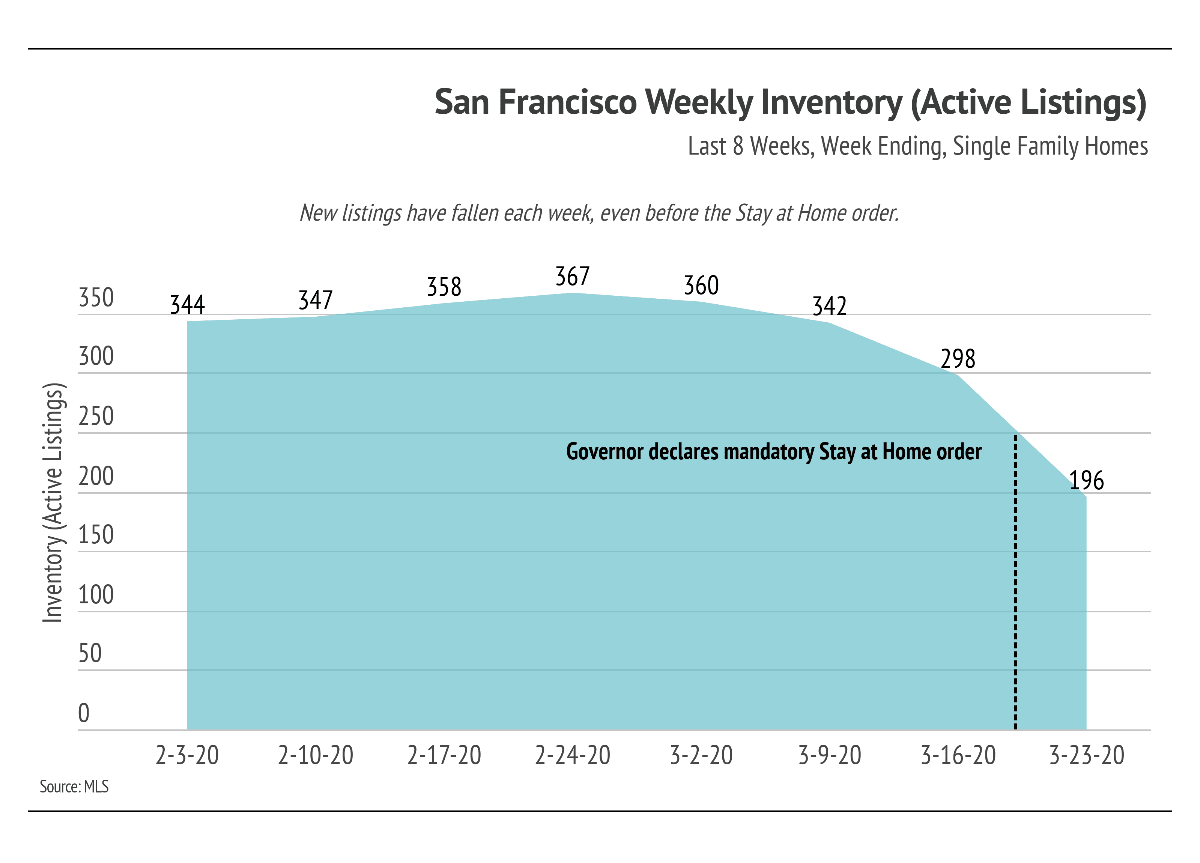

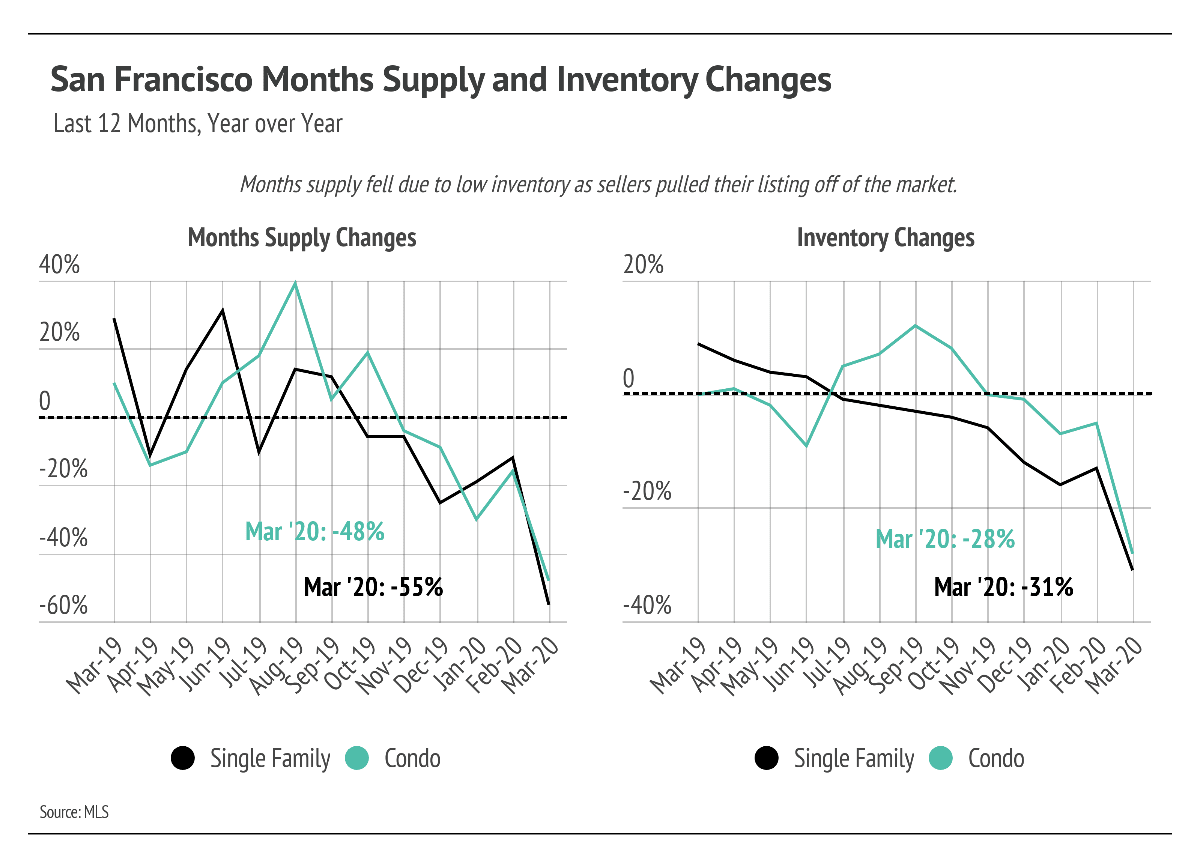

The pandemic’s impact on the housing market is progressing so rapidly that we can see its effects on a weekly basis. The graph below illustrates the available housing inventory not by month (as is typical) but by week. We can see that supply levels declined faster over the last week of March because California’s Governor Newson issued a statewide stay-at-home order. A decrease in active listings usually indicates a corresponding increase in sales. In the month of March, however, it showed a surge in listings being pulled off the market.

It is important to keep in mind that there is a lag of at least 30 days between when a contract is accepted and when the sale of a home finally closes. The means that March data, such as median sales prices, reflects the market before the shelter-in-place rules went into effect.

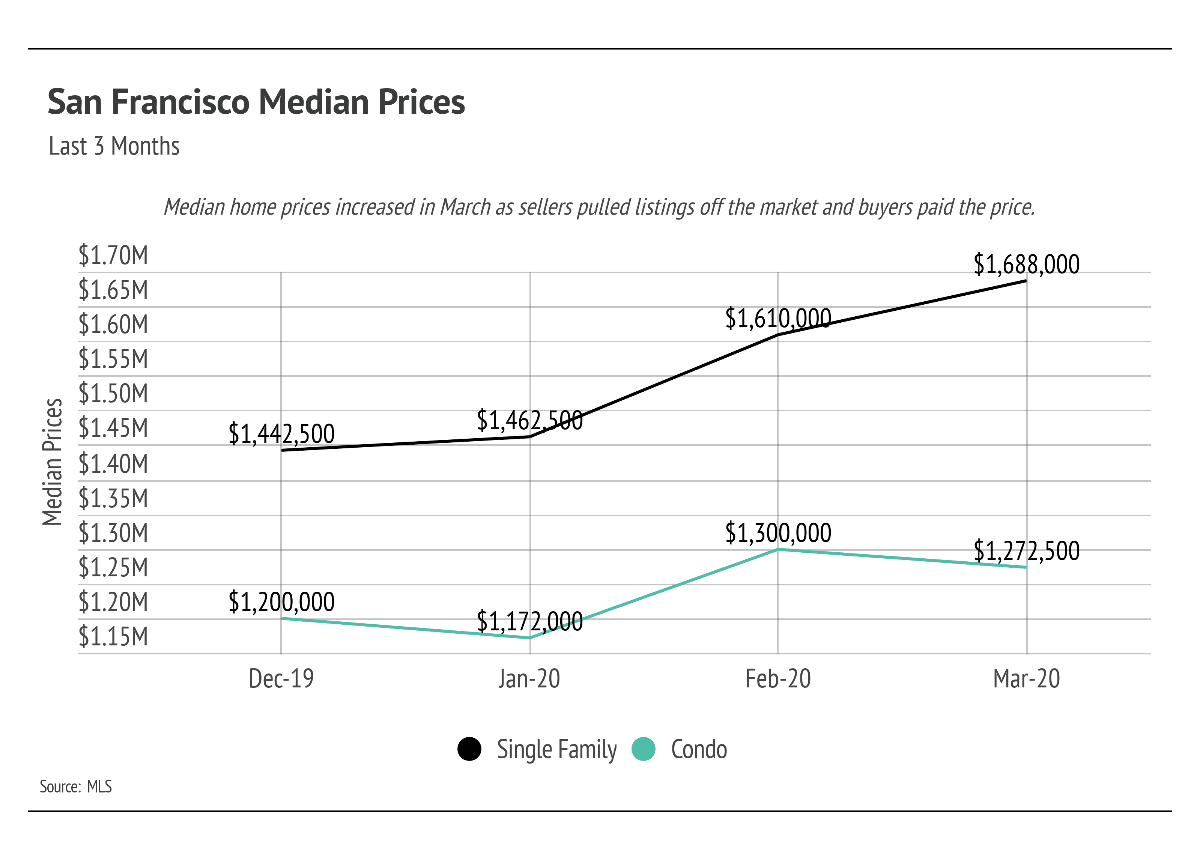

San Francisco’s median single-family home prices rose in March. Although the pandemic and stay-at-home orders dampened buyer demand, the number of active listings also decreased, which kept the price fairly stable. This puts more pressure on buyers to get offers accepted before conditions worsen and even more listings disappear.

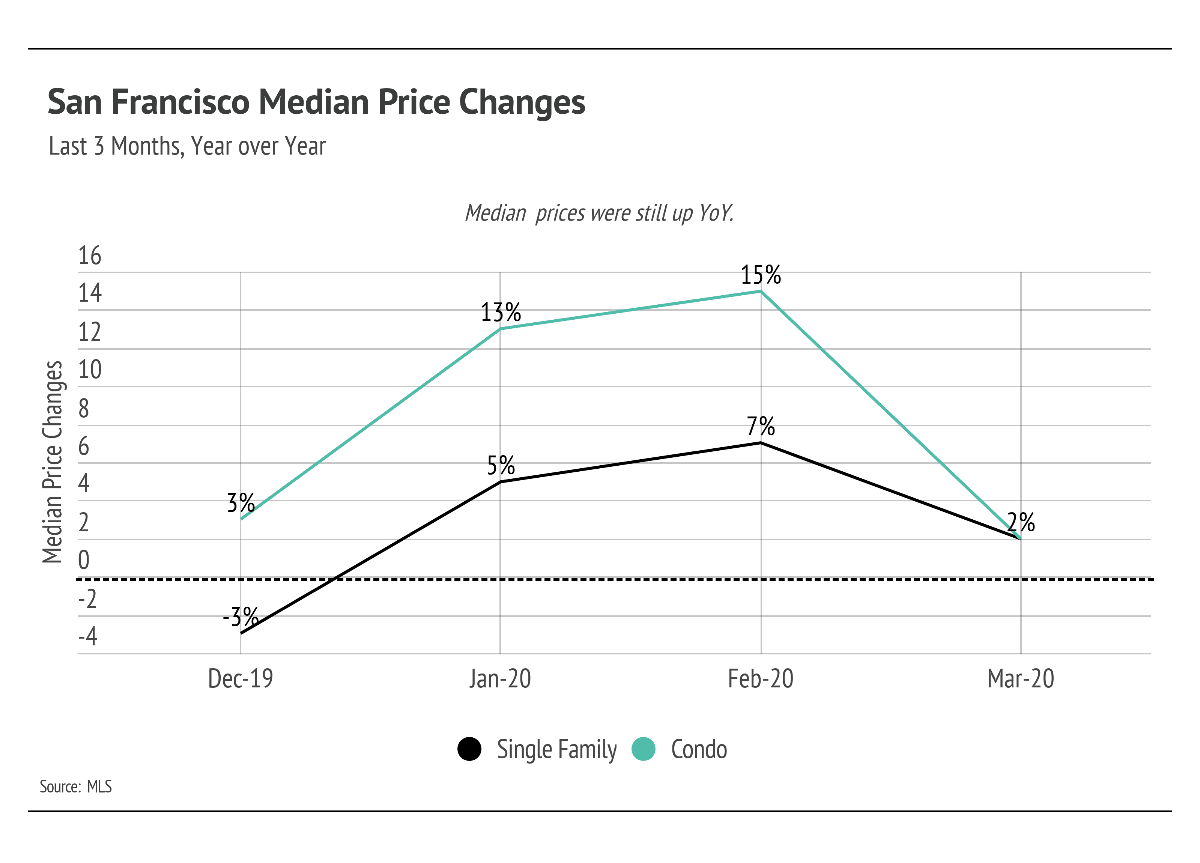

Compared to March 2019, prices were actually 2% higher for both single-family homes and condos in March 2020. For potential sellers wanting to list, appreciating prices typically signal a healthy demand for the available housing and encourage sellers to price their homes slightly above comparables.

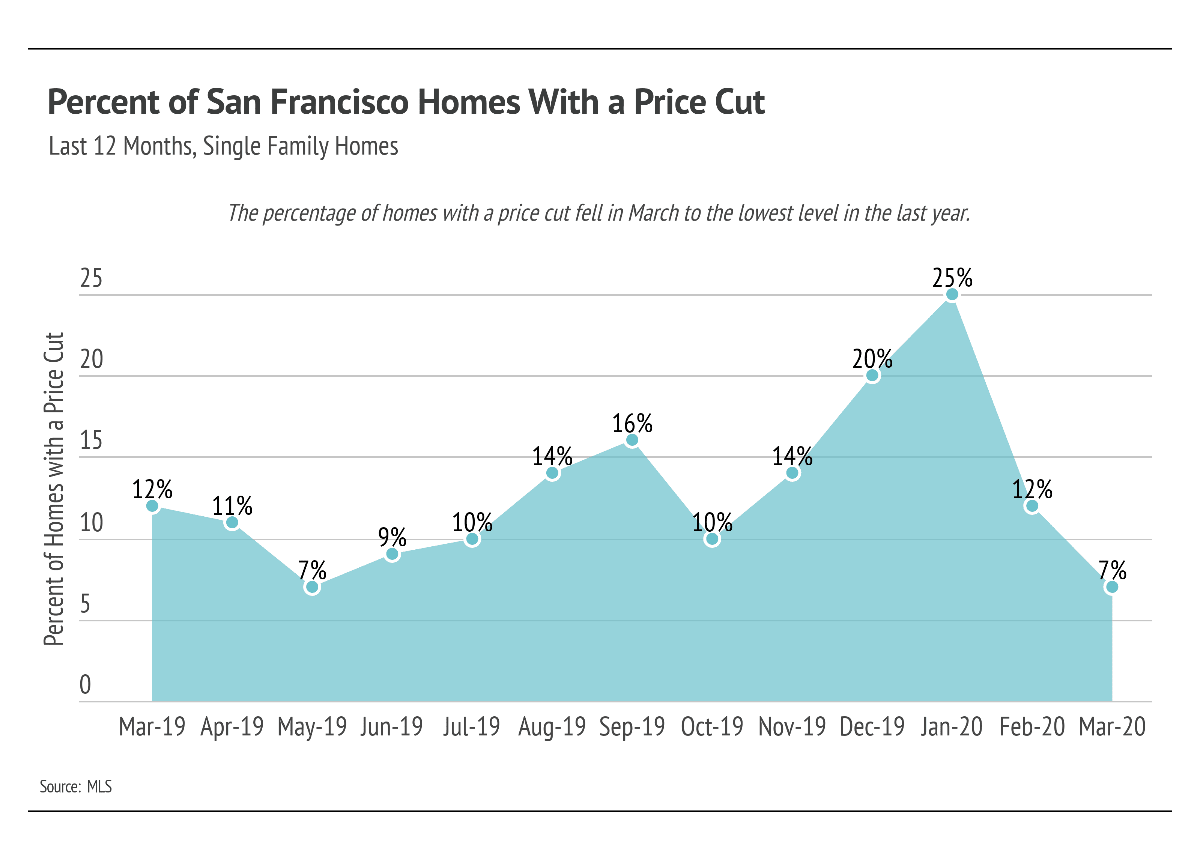

Along with a rise in median home prices, the percentage of homes that sold with a price cut fell to the lowest level in the past ten months. Only 7% of sellers had to reduce their prices in March, which means buyers were the ones making price concessions and competitive offers to get accepted.

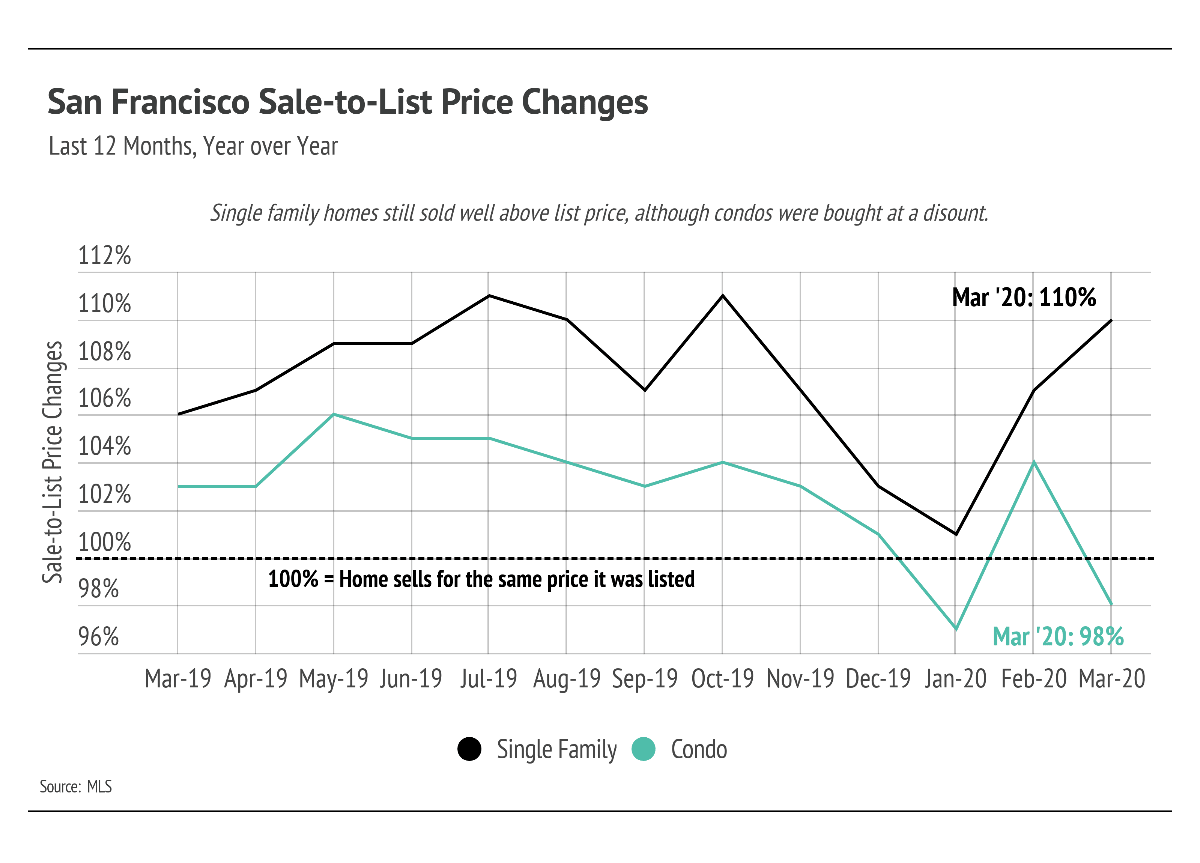

The sale-to-list ratio reflects the change in the original list price of a home and the final sale price. For example, a ratio of 100% means that a home sold for the price it was most recently listed. Single-family homes typically have higher sale-to-list ratios than condos. In March, buyers paid an even greater premium for single-family homes, which sold well above list (110%), while condos sold at a discount (98%).

Months supply of inventory measures how many months it would take for all current listings on the market (including listings under contract) to sell at the current rate of sales. In California’s high-demand market, a balanced supply level is three months, which means there are three months of housing inventory on the market at the current rate of sales. A market with less than three months supply of inventory favors sellers.

In March, supply shrank as sellers pulled their listings. In already tight markets like San Francisco, this rapid decline in supply was bad news for buyers.

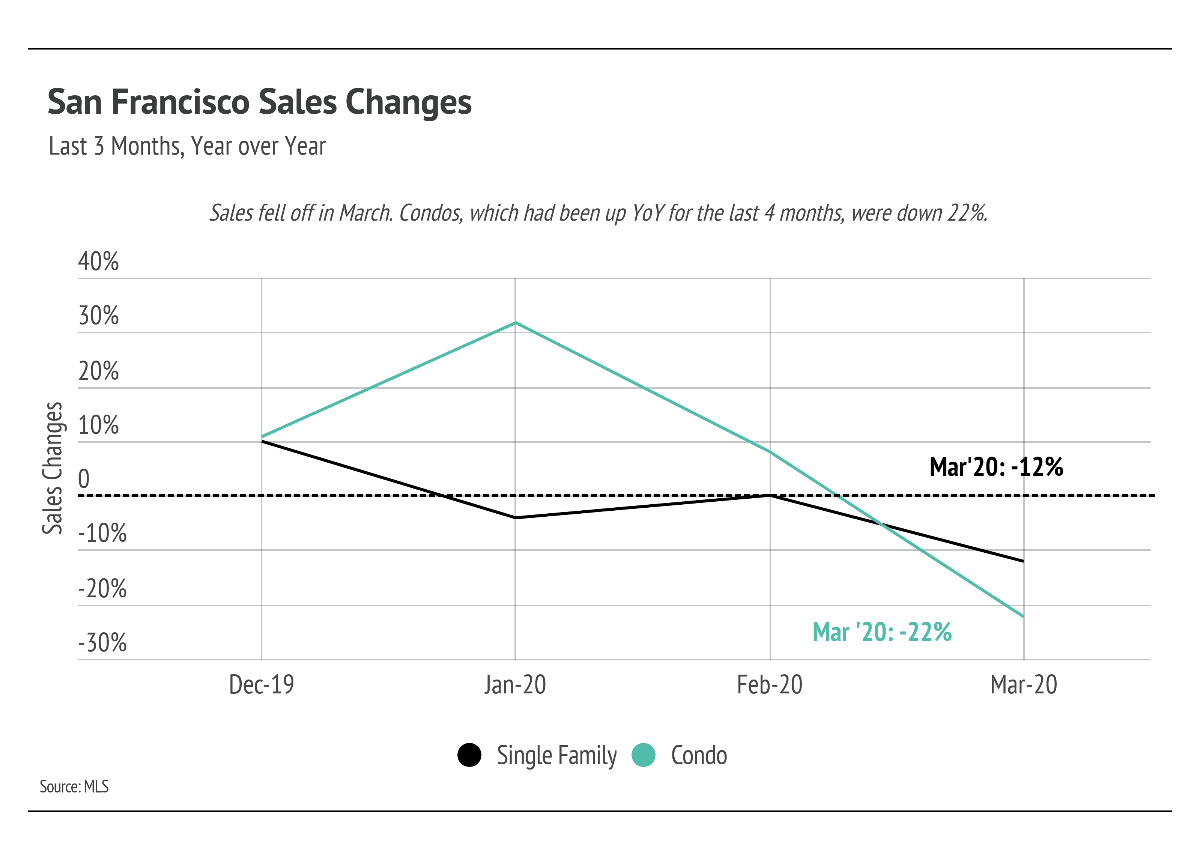

With less inventory on the market and less buyer demand, home sales fell for both single-family homes and condos. CAR’s Appleton-Young commented on this trend in her April market update:

“All sales volumes have been impacted at this point. I think it’s going to bottom and then as people figure out virtual transactions, it will come back up.”

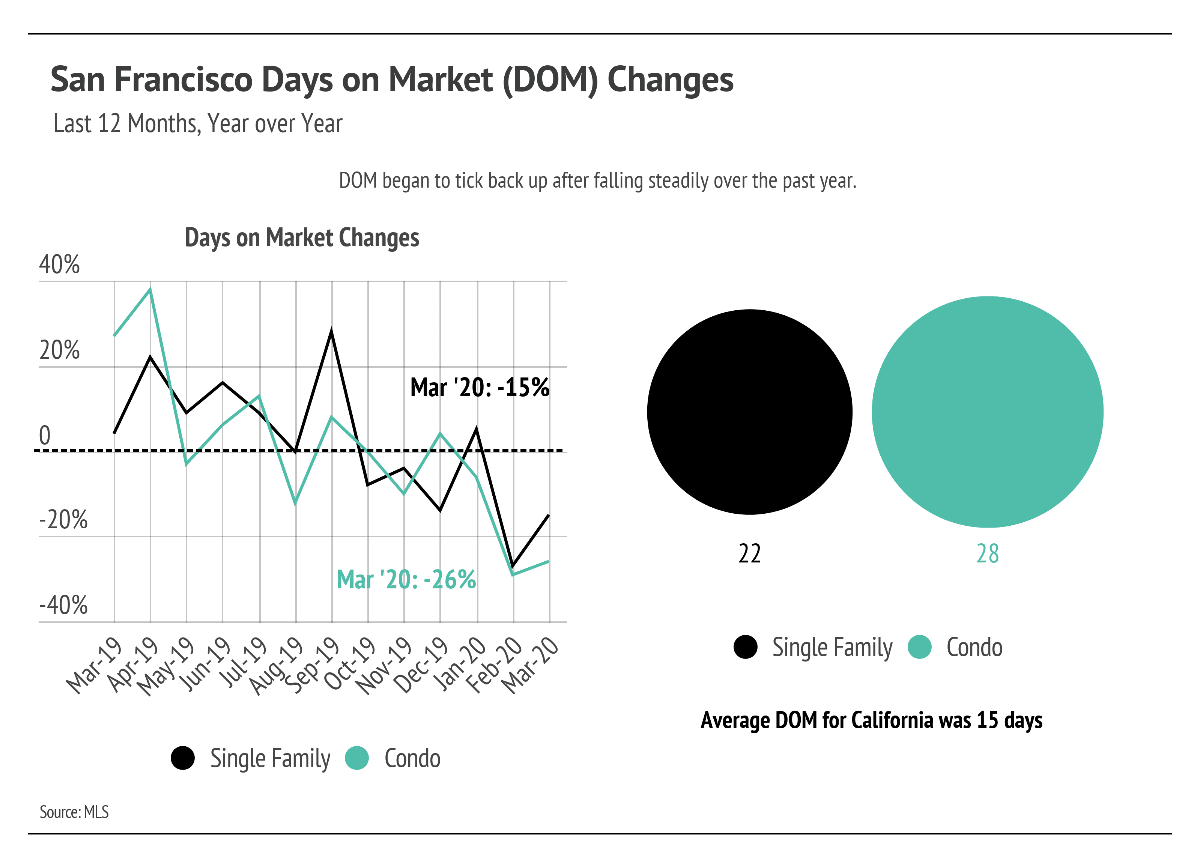

Lastly, we look at days on market (DOM), which measures how many days it takes a seller to accept an offer from the first day they list their home. DOM fell steadily for the last 12 months before beginning to tick up in March. The DOM is still lower now than it was this time last year, but moving forward, we expect homes to take longer to sell because many of the steps in the home-buying process are now being done virtually. While we pride ourselves on being on the forefront of virtual transactions, the process is new for many buyers and sellers. It will take time to get comfortable with the new way of doing business.

The California Association of Realtors’ guidance on reporting DOM has led us to believe that the metric will be highly unreliable in the near term, and we will no longer include this metric until a uniform process is decided. MLSs can independently choose to freeze DOM, which renders the metric unusable. With that, we know DOM will show a noticeable increase through the coming months as the sales process goes virtual. Usually DOM shows if a home was priced properly, but for the time being, we believe an increase in DOM for those that continue to list will not accurately reflect an improper price point.

Looking ahead to May, we anticipate that sellers will continue pulling listings off of the market, and buyer demand will dampen. For now, provided the two trends play out in tandem, there won’t be a significant impact on median home prices.

As we discussed in our February newsletter, the fundamentals of the housing market were strong before the global economy stalled. We believe that will help us all navigate this difficult time with as little consequence to the housing market as possible.

As always, we remain committed to helping our clients achieve their current or future real estate goals. Our team of experienced professionals would be happy to discuss the information we’ve shared in this newsletter. We welcome you to contact us with any questions about the current market or to request an evaluation of your home or condo.

Stay up to date on the latest real estate trends.

Michelle Kim | March 2, 2026

Quick Take: As interest rates continue to fall, median monthly P&I payments do as well, making housing slowly but surely more affordable on a national scale. Mortgage … Read more

Michelle Kim | March 2, 2026

Quick Take: The Bay Area closed out 2025 with unprecedented inventory contraction, with most regions experiencing 20-40% year-over-year inventory declines as the holid… Read more

Michelle Kim | March 2, 2026

Quick Take: Single-family median sale prices showed a mixed picture in January, with San Mateo and Santa Cruz Counties posting year-over-year gains while Santa Clara C… Read more

Michelle Kim | March 2, 2026

Quick Take: Single-family home prices posted modest year-over-year gains across both counties, while the condo market continued to slide with double-digit declines in … Read more

Michelle Kim | March 2, 2026

Quick Take: Median sale prices surged in Marin and Napa Counties, with single-family homes up 19.86% and 18.75% year-over-year, respectively, while Sonoma and Solano C… Read more

Michelle Kim | March 2, 2026

Quick Take: Single-family home prices surged by more than 16% year-over-year, marking one of the strongest January performances in recent memory. Inventory levels rema… Read more

You’ve got questions and we can’t wait to answer them.