San Francisco Real Estate Market Report: March 2021

michelle March 4, 2021

michelle March 4, 2021

Welcome to our March newsletter. This month, we cover long-term trends in the United States, considering the ways in which history can inform our future. We also compare the 2020 and 2019 calendar years in our local area, using 2019 as a “normal” year to reflect upon 2020 trends.

We don’t want to jinx anything, but we may have turned the corner on the pandemic. New cases are declining after peaking in early January, and the United States is administering over 1 million vaccinations a day. Whether we are on the back side or not, COVID-19 will have lasting effects on how we live and work. In particular, the pandemic has substantially raised housing demand. Working from home, or at least working in non-office settings, is here to stay, and all-time-low mortgage rates have incentivized renters to enter the housing market because the cost of buying may be lower than renting. For these reasons, we suspect that demand will continue to remain high through 2021.

As we navigate an ever-changing economic landscape, we remain committed to providing you with the most up-to-date market information so you feel supported and informed in your buying and selling decisions.

In this month’s newsletter, we cover the following:

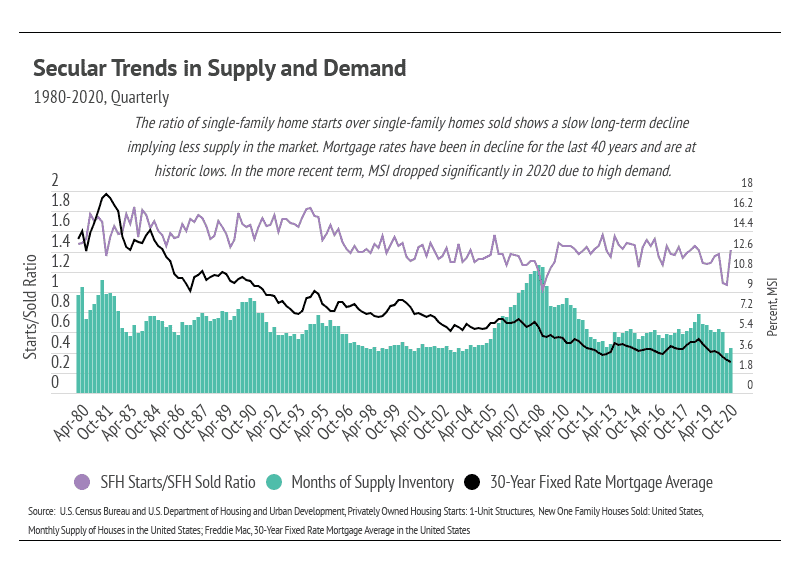

This month, we are taking a step back from discussing short-term trends so that we can dive into secular trends (trends that are neither seasonal nor cyclical) to help us understand the current housing environment. We use three metrics in the chart below—the ratio of single-family home starts (new construction)/single-family homes sold, Months of Supply Inventory, and average 30-year fixed mortgage rates—as they all provide insight into supply and demand. The first two metrics indicate levels of supply and demand. The ratio of single-family home starts to new single-family homes sold indicates the level of production versus demand, while Months of Supply Inventory (MSI) reflects the number of months it would take for the current inventory of homes on the market to sell given the current sales pace. The third metric, average 30-year fixed mortgage rates, shows the cost of financing a home.

1980-1995

The early 1980s marked the highest mortgage rates in the United States—over 18%—as well as the secular decline in rates since that peak. During the 16-year period between 1980 and 1995, the ratio of housing starts to homes sold stayed fairly stable, which is ideal in terms of equilibrium in supply and demand. However, MSI began to shift lower around 1990, indicating that demand was increasing relative to supply. We saw a small peak in MSI in 1995, which declined until the housing bubble began to burst in 2005. During this period, mortgage rates experienced the steepest drop, with an approximately 11% decline. The difference in mortgage payment from 18% to 7% equates to about $10,000 per month in savings on a $1 million mortgage, making homes much more affordable.

1995-2005

This period contained an economic growth cycle. Demand for housing dramatically increased, while the housing-starts-to-new-homes-sold ratio declined and MSI decreased and held at around four months of supply. Credit lending standards during this 11-year period were extremely lax while mortgage rates continued to decline, which further increased demand. Home prices more than doubled from 2000 to 2005. This period marked the beginning of the housing market decline and home appreciation deceleration.

2005-2020

Typically, MSI and the housing-starts-to-new-homes-sold ratio track together, but from 2005 to 2010, they started to show an inverse relationship. MSI rose, while the ratio declined. This happened because, with the Great Recession, demand and new production dropped precipitously and didn’t rebound until 2012. After 2012, the housing recovery began, and we experienced another stable state with fairly steady supply and demand dynamics and consistently low mortgage rates.

During the pandemic and the resulting recession in 2020, mortgage rates fell further, and demand increased dramatically. MSI dropped sharply in 2020 due to high demand and dwindling supply. Mortgage rates have never been lower, which incentivizes more people to enter the market.

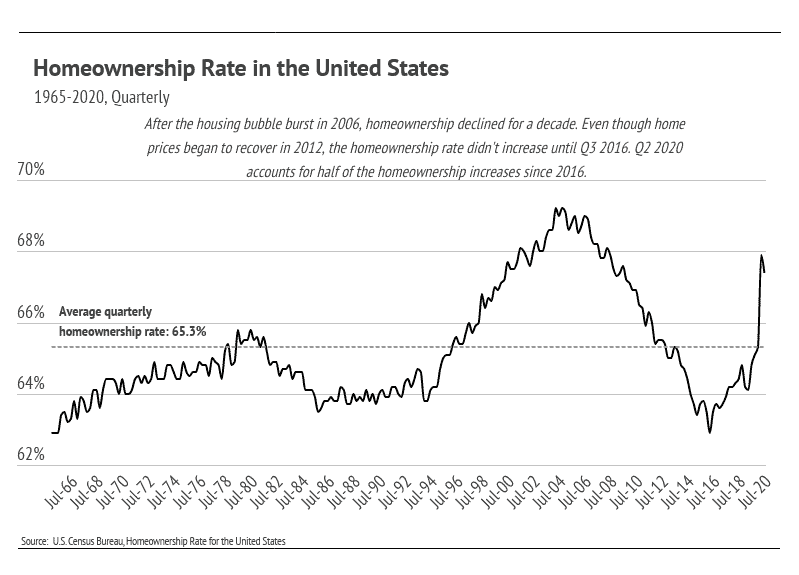

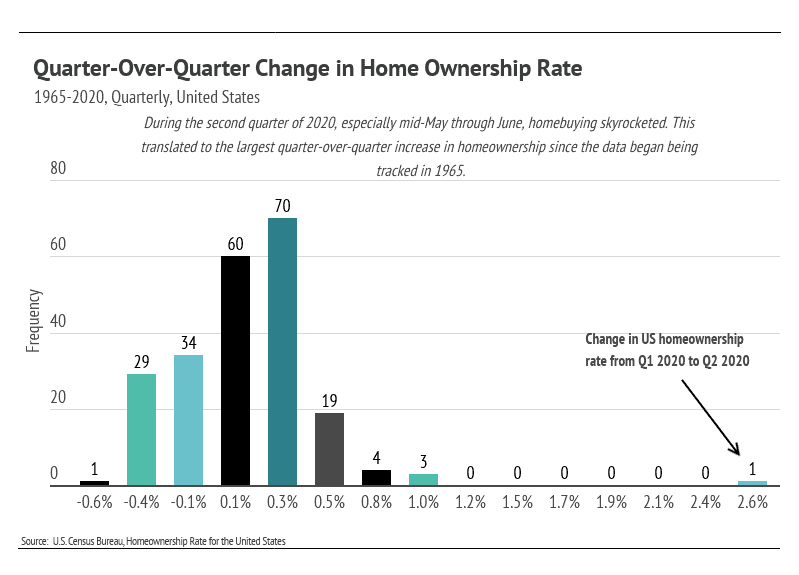

The significance of the buying frenzies from 1995 to 2005 and during 2020 is best reflected in the homeownership rate, which also shows the lingering effects of the housing bubble. Home prices started increasing again in 2012, but the homeownership rate declined until 2016. From 2016 to 2020, about half of the homeownership increase occurred in the second quarter of 2020 alone.

It’s difficult to overstate just how unique homebuying trends were in 2020. The homeownership rate increased 2.6% over a single quarter. For reference, out of 223 quarters, only three other quarters had a change above 1%. This was a gigantic jump.

Although we do not expect the same level of buying in 2021, the environment is right for sustained high demand. Supply remains low, and we anticipate a competitive landscape for buyers over the course of this year.

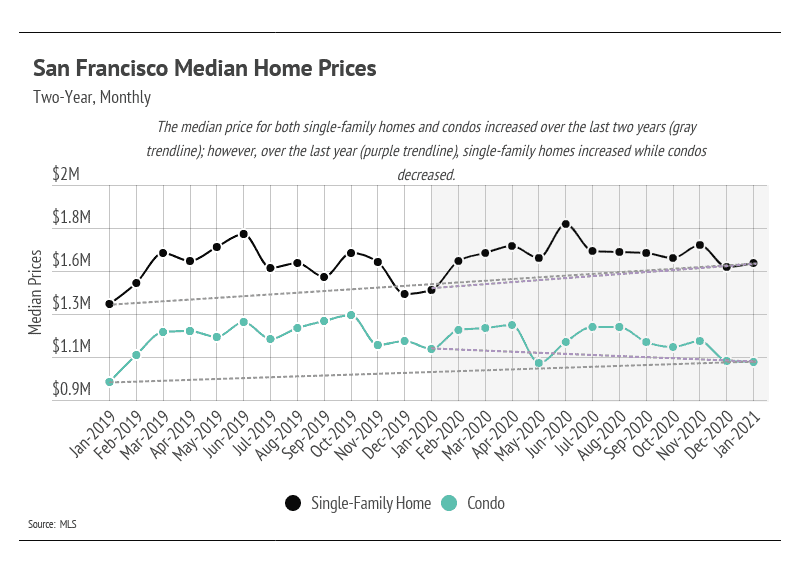

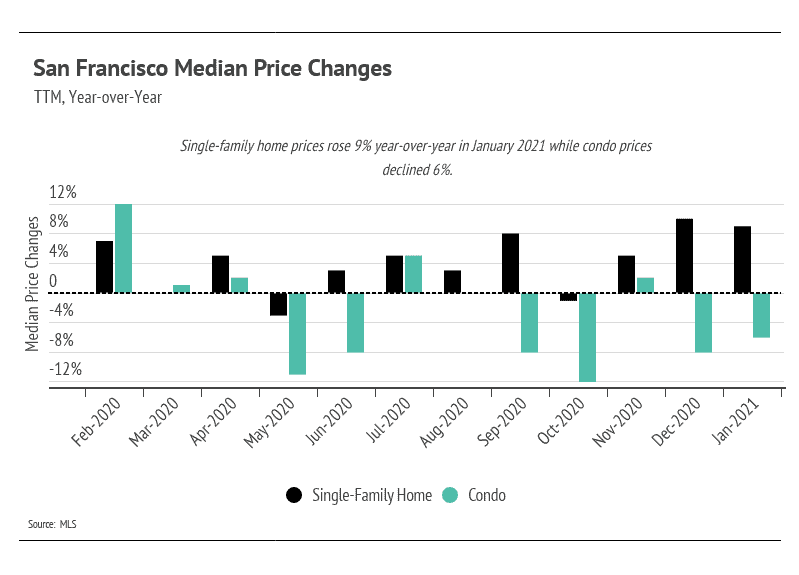

The median single-family home price rose slightly, and condo prices saw a minor decline month-over-month. Year-over-year, single-family home prices increased by 9%, while condo prices declined 6%.

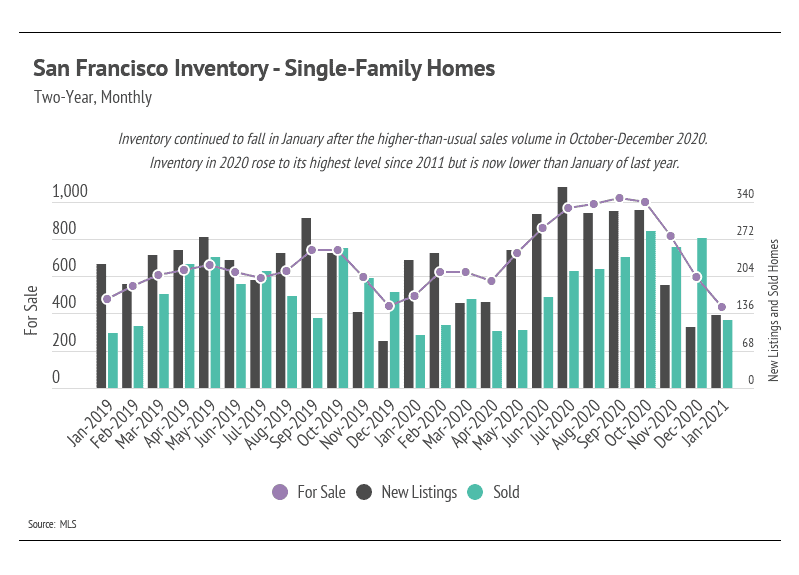

In 2020, single-family home inventory increased to its highest level since 2011. During 2020, we saw overexaggerated reports of a San Francisco exodus when the larger issue was fewer workers transplanting to the city with the advent of near-universal remote working. From May to September 2020 (five months), inventory exploded. But we need to look at it through the lens of a city in a constant state of single-family home undersupply. Despite such a meteoric rise, inventory fell even faster than it rose, which speaks to the desirability of San Francisco. By January 2021, inventory declined to lower levels than January 2020. With such a consistently high level of demand, prices will likely continue to appreciate throughout 2021.

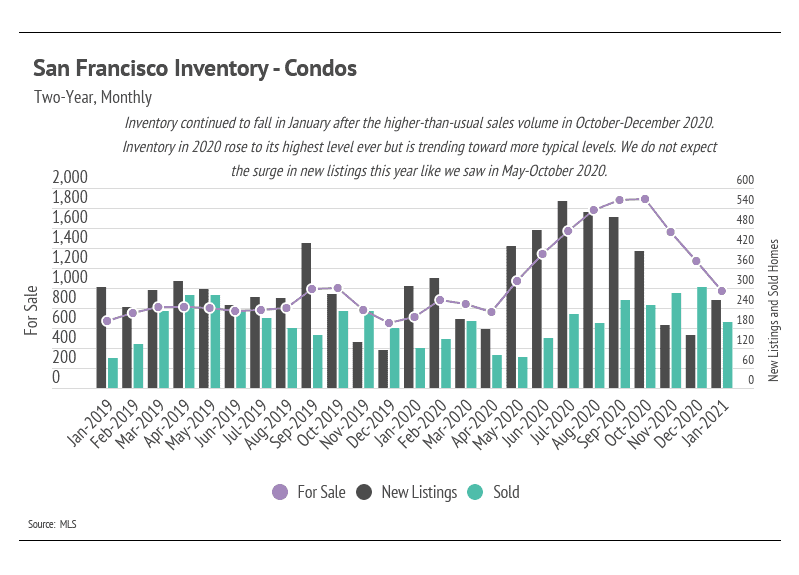

By contrast, condos are still in a state of oversupply relative to past years. Condo inventory rose from May to October 2020 (six months) to the highest level ever. Although inventory has declined significantly over the last four months, inventory in January 2021 is much higher than last year. The sustained level of excess supply has reduced prices for condos into the new year and will likely persist through the winter months.

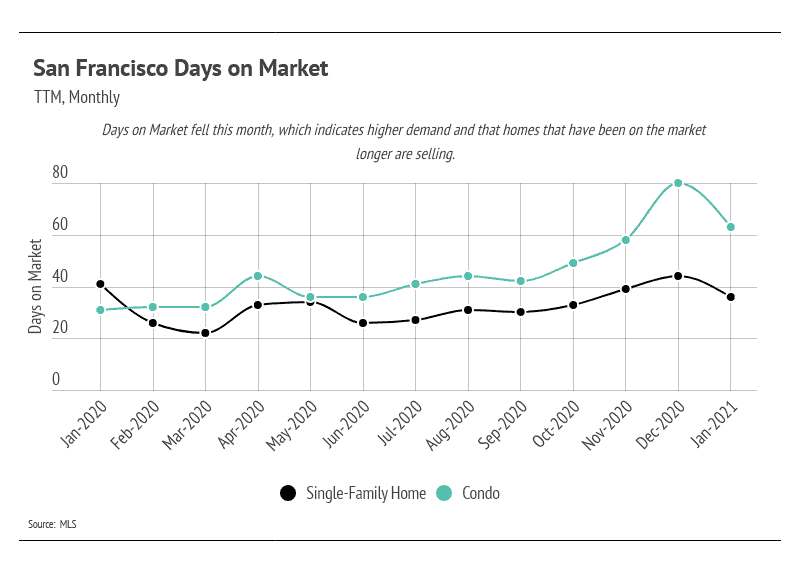

Days on Market (DOM) declined marginally for single-family homes relative to January 2020, while condo DOM doubled over the last 12 months. However, as inventory has shown a significant reduction, the DOM for both single-family homes and condos declined in January 2021.

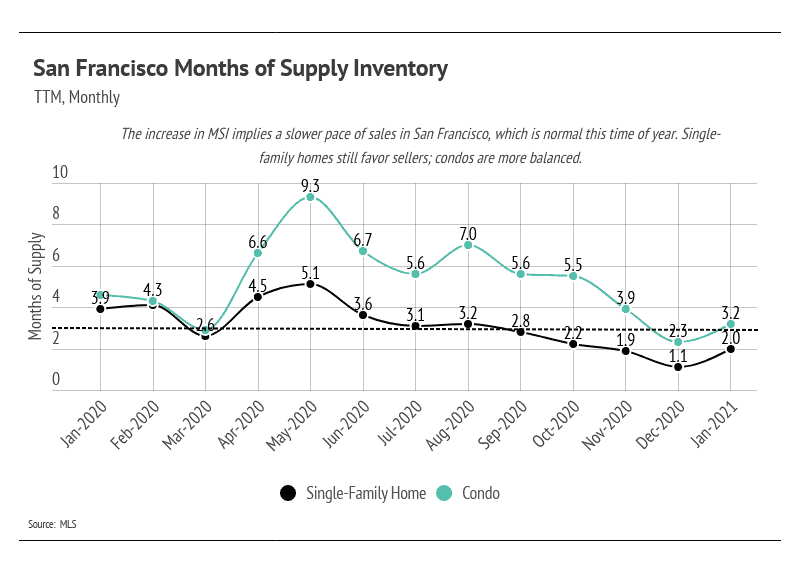

We can use MSI as a metric to judge whether the market favors buyers or sellers. The average MSI is three months in California (far lower than the national average of six months), which indicates a balanced market. An MSI lower than three means that buyers dominate the market, and there are relatively few sellers (i.e., it is a sellers’ market), while a higher MSI means there are more sellers than buyers (i.e., it is a buyers’ market). With a decline in sales volume, the MSI rose in January 2021 to 2 months of supply for single-family homes, still favoring sellers, and to 3.2 months of supply for condos, which is more balanced.

In summary, the high demand for single-family homes present in San Francisco has buoyed home prices. Inventory for single-family homes and condos will likely decline further this year, and fewer sellers will likely come to market, potentially lifting prices higher. Overall, the housing market has shown its resilience through the pandemic and remains one of the most valuable asset classes. The data show that housing has remained consistently strong through this period. Potential condo buyers have a unique opportunity to find a home, with more inventory to choose from and low cost of financing.

We anticipate new listings to slow until around March 2021. While the winter season tends to see a slowdown in activity, January 2021 showed higher-than-normal sales, once again highlighting the desirability of San Francisco.

As always, we remain committed to helping our clients achieve their current and future real estate goals. Our team of experienced professionals are happy to discuss the information we’ve shared in this newsletter. We welcome you to contact us with any questions about the current market or to request an evaluation of your home or condo.

Stay up to date on the latest real estate trends.

You’ve got questions and we can’t wait to answer them.