San Francisco Real Estate Market Report: July 2020

michelle June 29, 2020

michelle June 29, 2020

Welcome to our July newsletter. This month, we’ll continue to update you with important information about your local real estate market. First, we will cover new survey data from the California Association of Realtors (CAR) that shows buyers and sellers are operating under differing expectations about the real estate market. Following that, we will review the local market. Although 2020 is proving to be unique, we hope to provide you with an encouraging analysis of June’s housing data as well as an overview of our expectations moving forward as we phase out of the strict stay-at-home orders.

This month’s topics include:

Since most California counties are beginning to lift restrictions, we will start to see the housing market steadily recover. Although an exact end date to quarantine does not exist, on May 20th, Governor Newsom confirmed that more than half of the state’s 58 counties were moving into phase two of the widely adopted “four-pronged approach.”

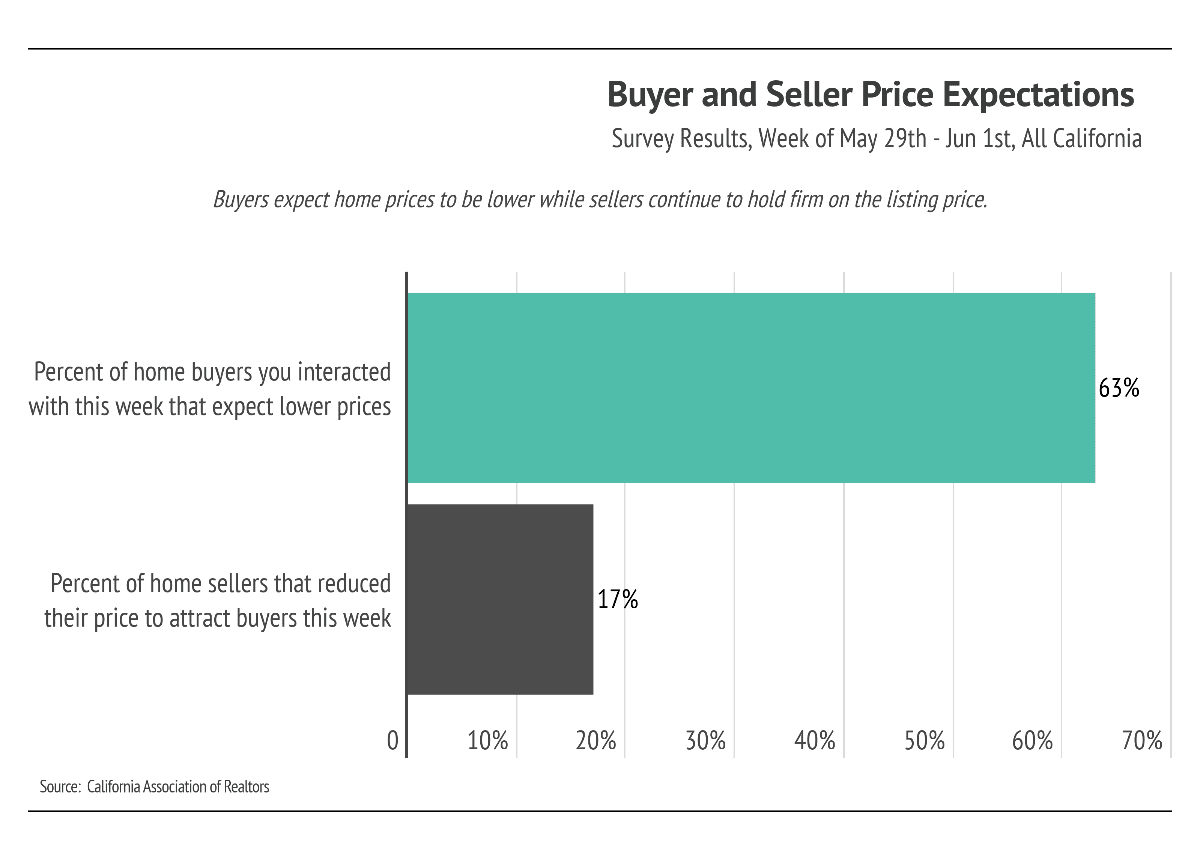

On June 3rd, the California Association of Realtors (CAR) released survey data sampling California agents and their clients over the last week of May. The results revealed that buyers and sellers are now operating under very different expectations about the real estate market: the majority of buyers expect home prices to be lower while only a small number of sellers are reducing their listing prices.

In the long run, who is right will depend on how long the economic recovery takes. In the short term, however, the data tells us that single-family home buyers appear to have wishful thinking, while condo buyers appear to be correct.

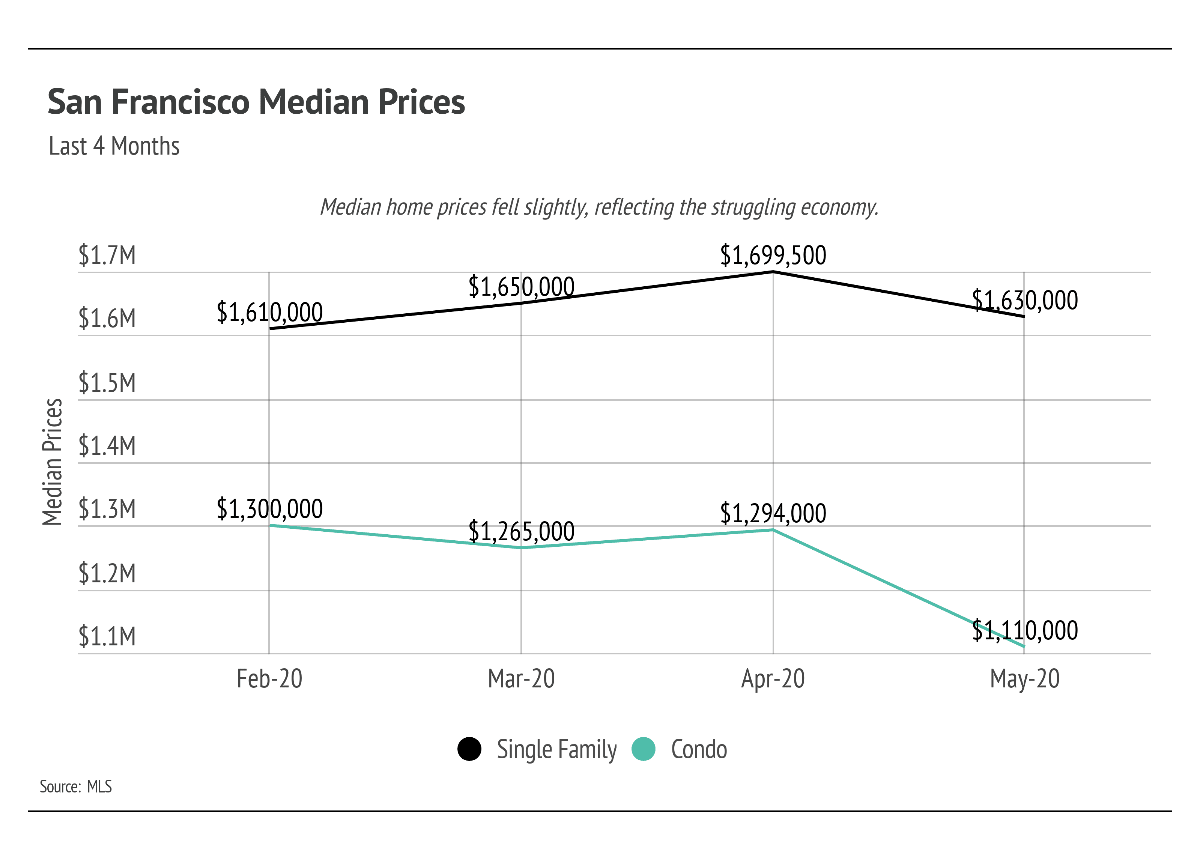

San Francisco median home prices did not decline enough for sellers to cut the listing price. In May, single-family home prices dipped slightly compared to April, but they continued to look resilient. Prices, however, were still higher compared to February before the pandemic began.

Condo prices, on the other hand, saw a decline of almost 9% from April to May. While prices actually increased by 1% on a per square foot basis compared to both April and February, we will see in the next section that the condo market is struggling in other key market indicators.

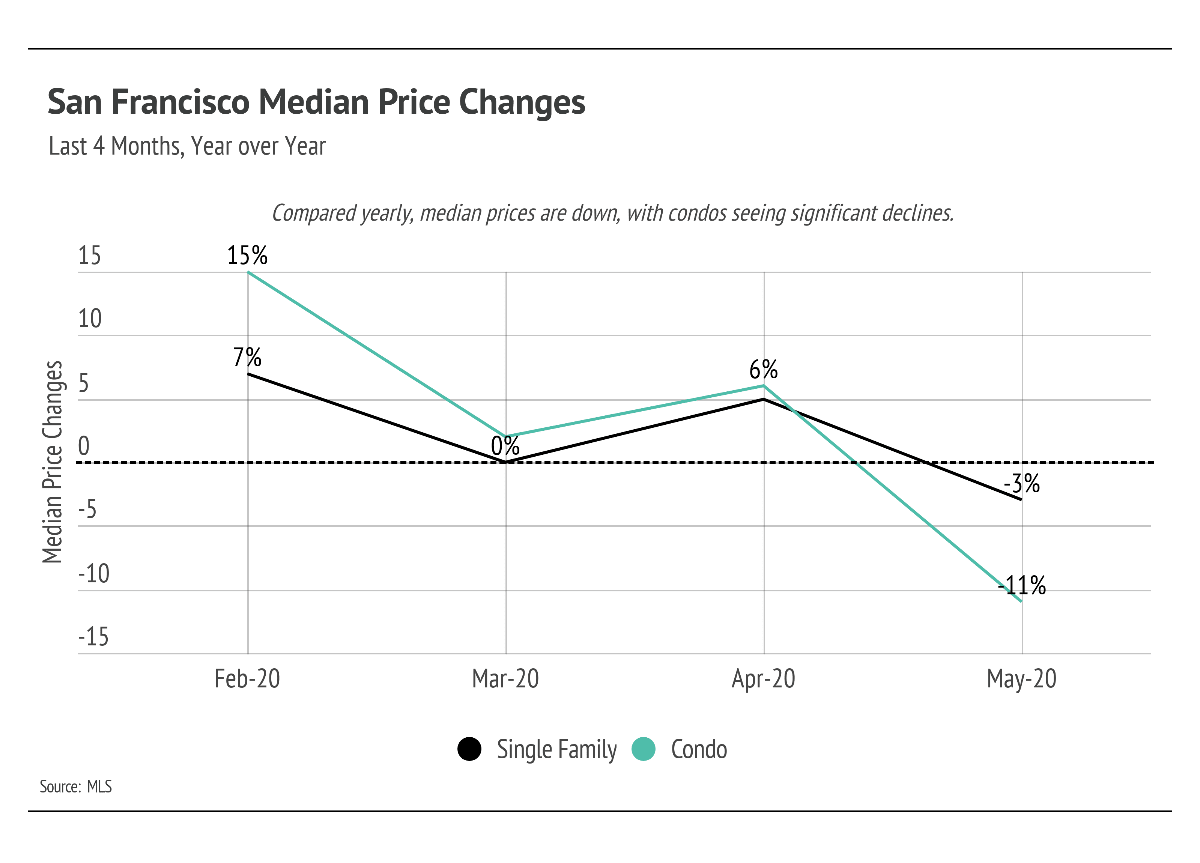

Compared yearly, prices were down for both single-family homes and condos. Single-family home prices were only down by 3% in May year-over-year. The more volatile condo market reported double digit declines compared to last year and have been trending down since February.

The year-over-year price decline was the first in San Francisco since the pandemic began. Weighing in on the subject in his June 3rd market update, Jordan Levine, Deputy Chief Economist at CAR, said:

“We [now] expect some price impacts eventually as a result of some of the negative economic impact. […] The price impacts will be in the modest category of the low single digits for 2020.”

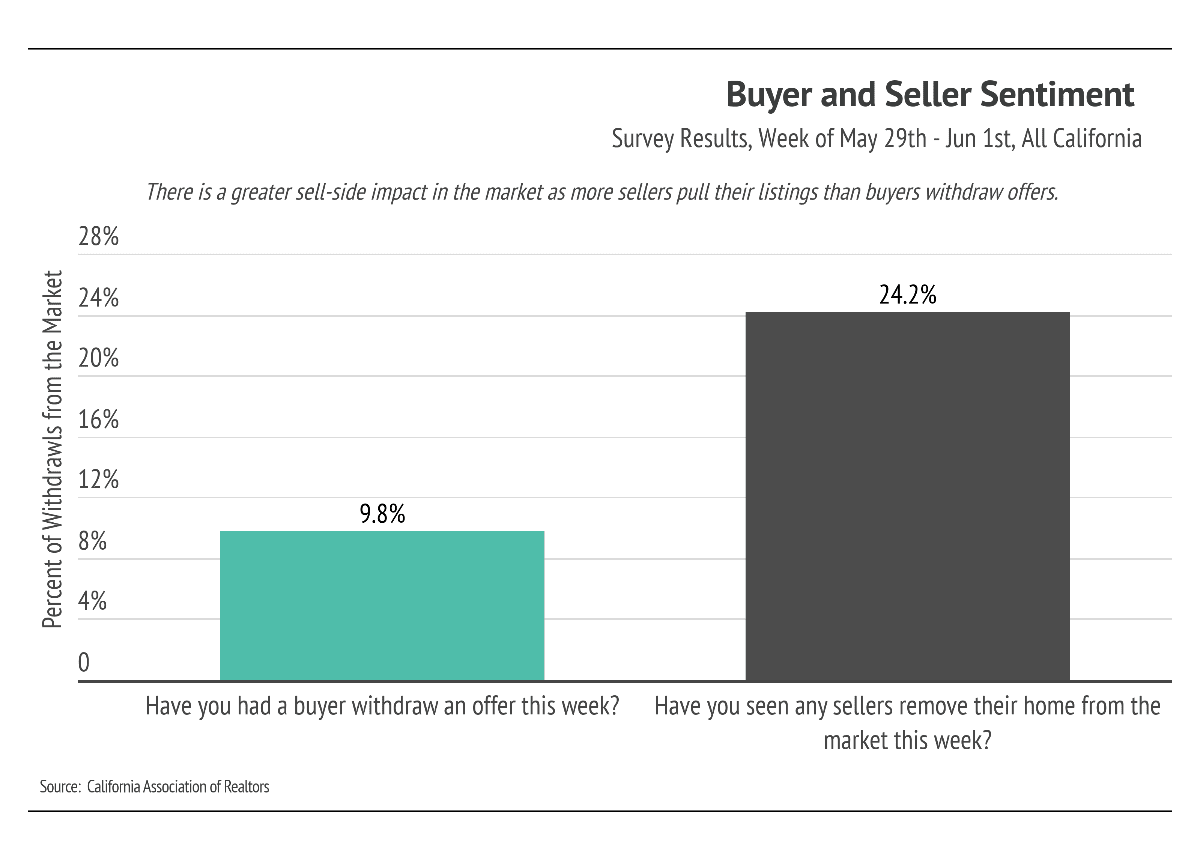

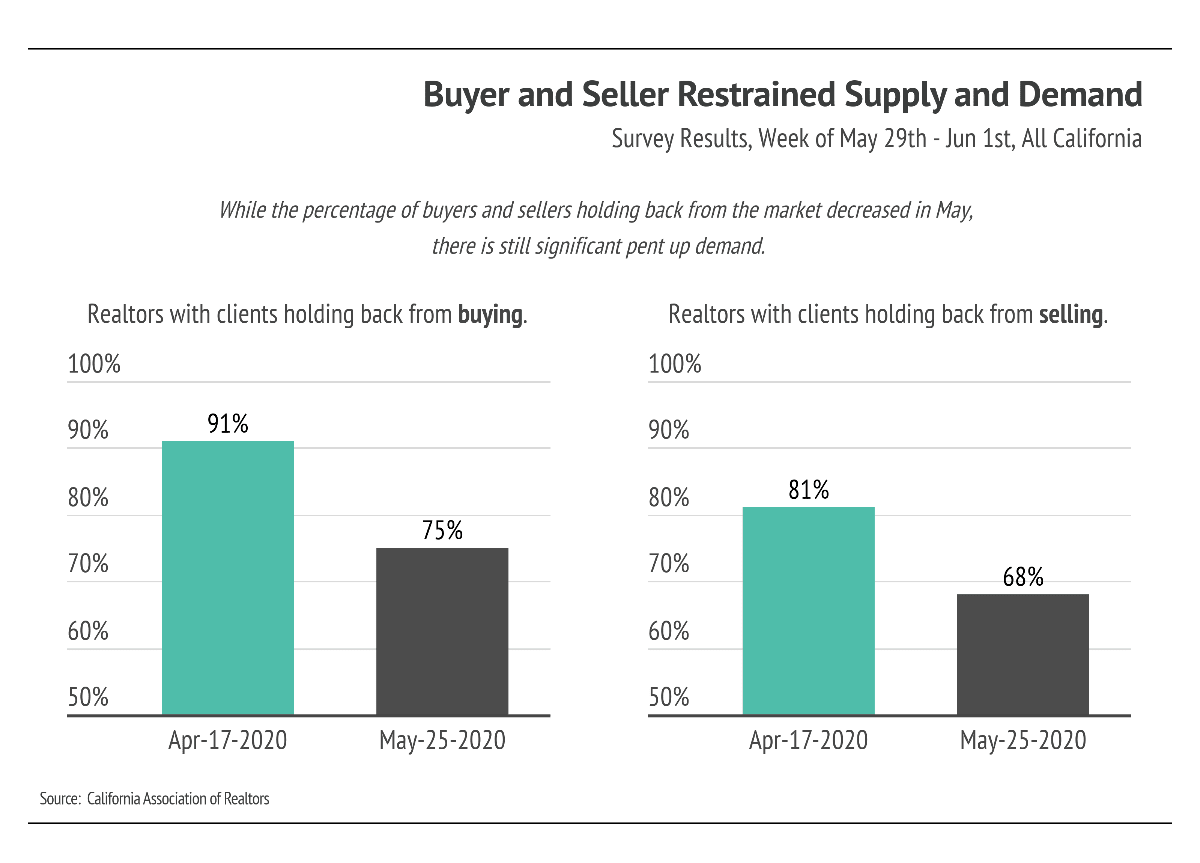

Evidence supports the idea that price declines will only be in the low single digits for the 2020 calendar year. The market continues to see a larger sell-side impact, meaning that housing supply has declined more than buyer demand. The survey data below shows that far more sellers withdrew listings than buyers withdrew offers.

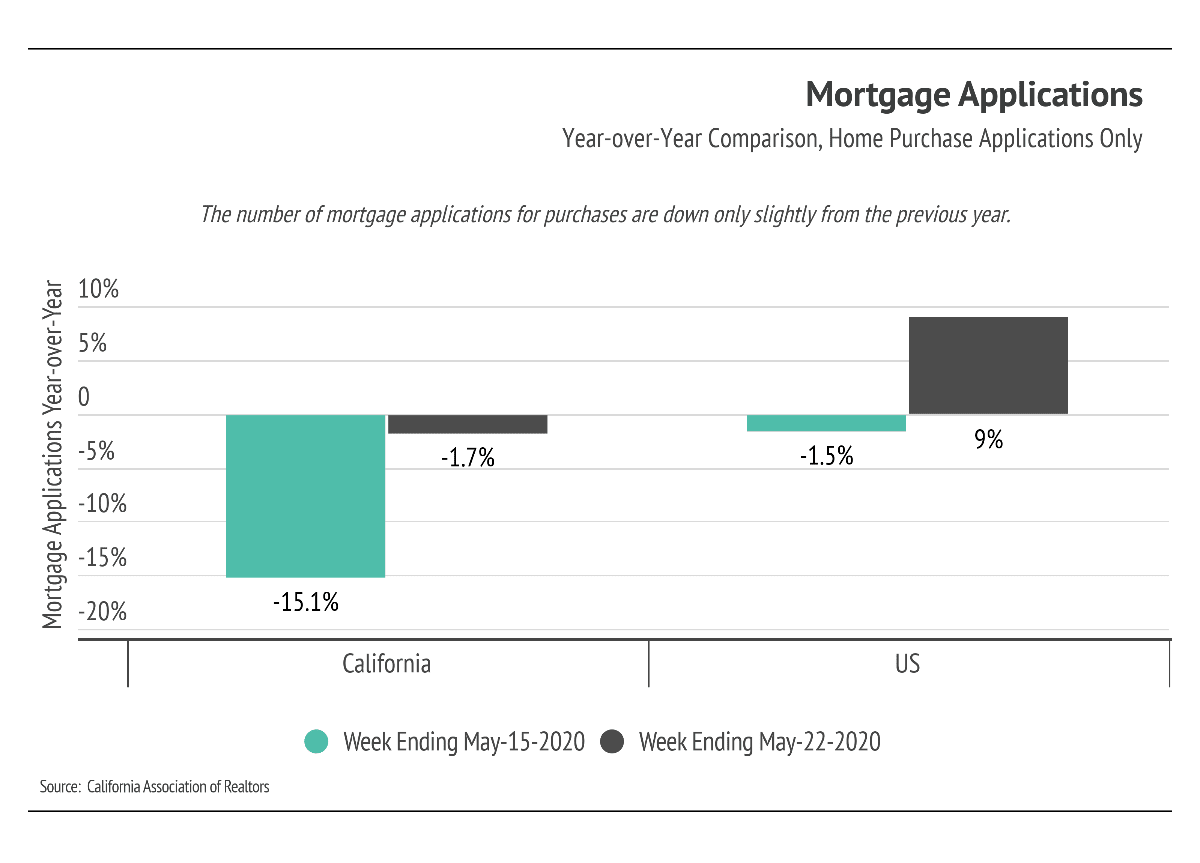

While sellers continue to grapple with the state of the market, California is again facing a major housing shortage, which prevents prices from dropping. The CAR survey also provided the most recent mortgage application data for both California and the United States. In May, California mortgage applications for home purchases (as opposed to refinances) rose significantly from April and are only down 1.7% from this time last year. Mortgage applications correlate with buyer intent to purchase a property and indicate the number of homes under contract and home sold.

All of this is welcome news. The May data assures homeowners that their home equity is still intact as restrictions begin to lift. It should also encourage buyers who may have been delaying a home purchase to enter the market.

A fourth CAR survey result illustrates the degree to which both supply and demand is currently stagnating. Over half of the California realtors surveyed indicated that they had at least one client that was delaying buying or selling until conditions changed. We assume that this pent-up demand will give way in the coming months to more participation and market activity from both sides.

Alongside pent-up demand, there are the changes to daily living which may impact home purchasing decisions in the future. In order to ensure employee safety, companies have massively shifted toward a remote workforce, which creates new space requirements for potentially millions of Americans. As a result, millions of Americans may need to consider purchasing a new home that better accommodates work from home. Remote work also means employees can live almost anywhere. Without physical restrictions, employees may look elsewhere for places to live such as locations with lower costs of living. Between new housing requirements, low rates, and pent-up activity, there is potential for a busy summer buying season that is similar to what we usually see in the spring.

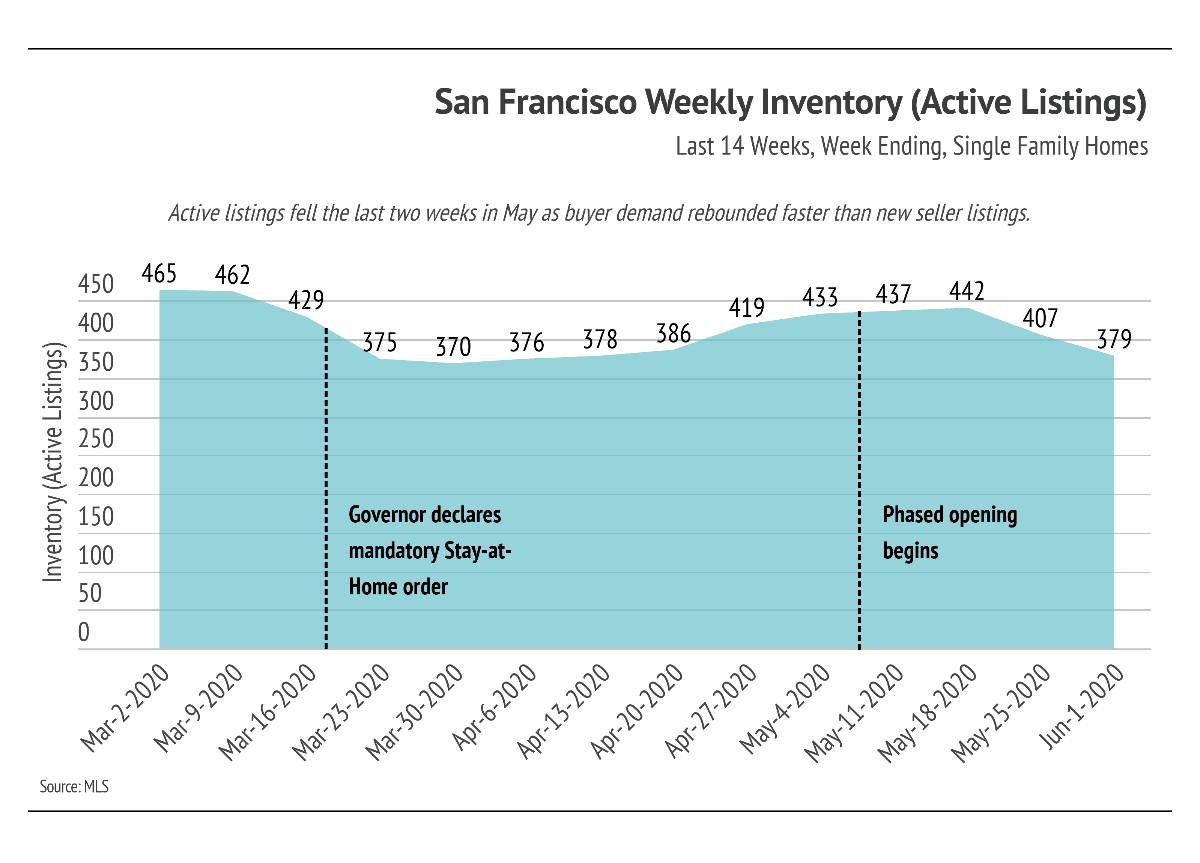

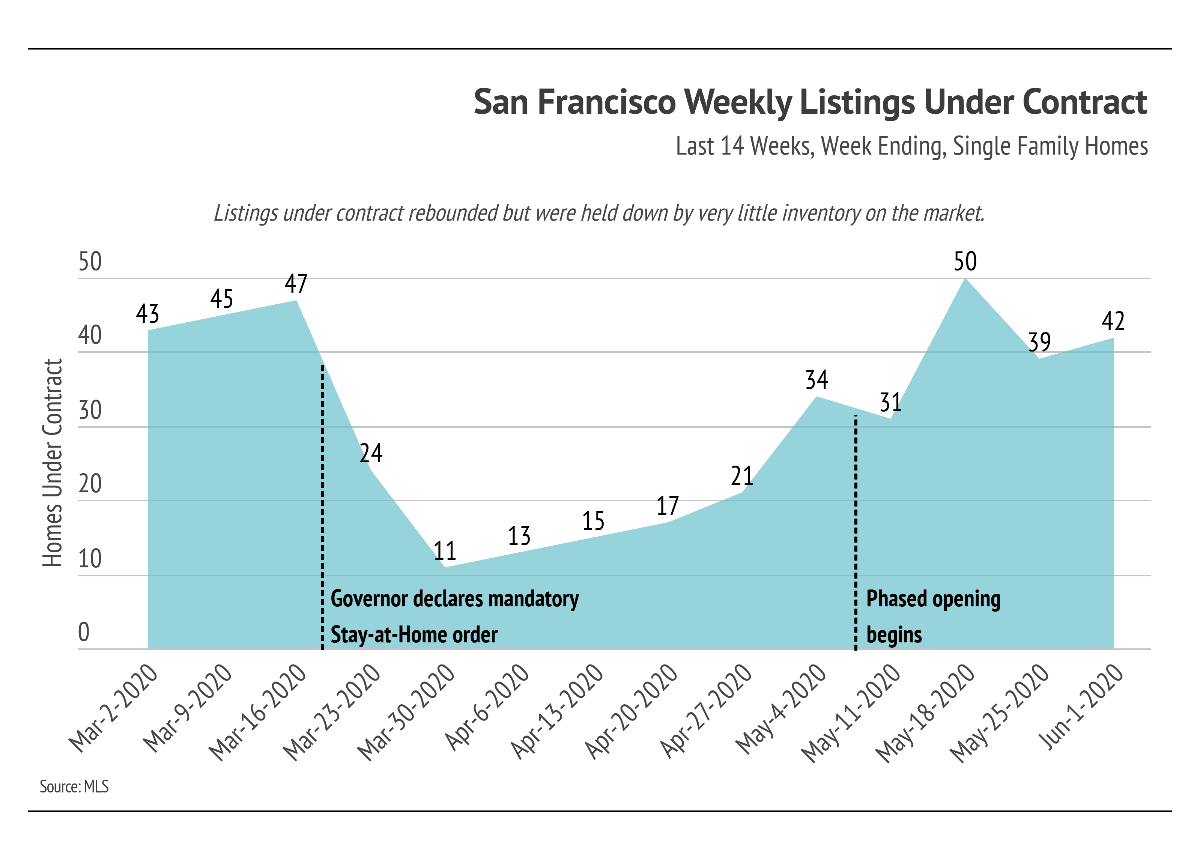

Over the last three months, the housing market has changed so rapidly that we began to look at the data on a weekly basis rather than a monthly basis (as is typical) to illustrate how significantly the market has changed over a shorter timeline.

In the month of May, the weekly San Francisco housing data for single-family homes supported the survey data from CAR. First, housing inventory is again declining and is near its March low as sellers continue to hesitate and withdraw listings from the market.

With less available housing for buyers to consider, the number of listings under contract is struggling to rise above its pre-pandemic levels in February. Homes under contract peaked in the third week of May (50), but they were followed by weaker numbers the next two weeks.

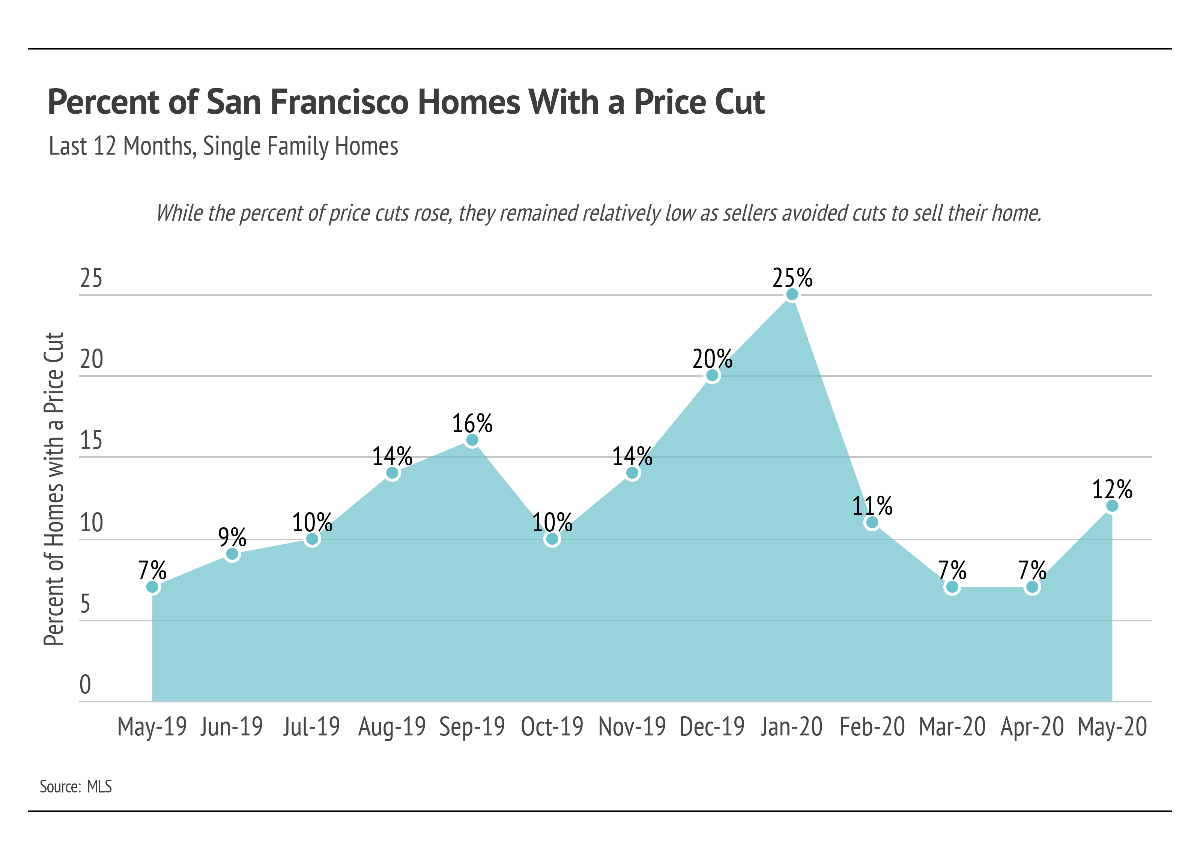

The June CAR survey data shows that 17% of sellers state-wide cut their prices. In San Francisco, 12% of single-family home prices were cut, which is a very low level. In our May newsletter, we reported that many sellers were reluctant to lower their list prices, asserting that the failure to sell was due to the pandemic, rather than an overpriced home. Assuredly, a portion of these homes are overpriced, but, conversely, the pandemic could be encouraging fewer price cuts than normal.

Condo price cuts increased to 24% in May, up from 13% in April. While this is not atypical (the percent of price cuts in December and January were 34% and 36%, respectively), it shows another divergence from the single-family home market and signals that prices may retreat further.

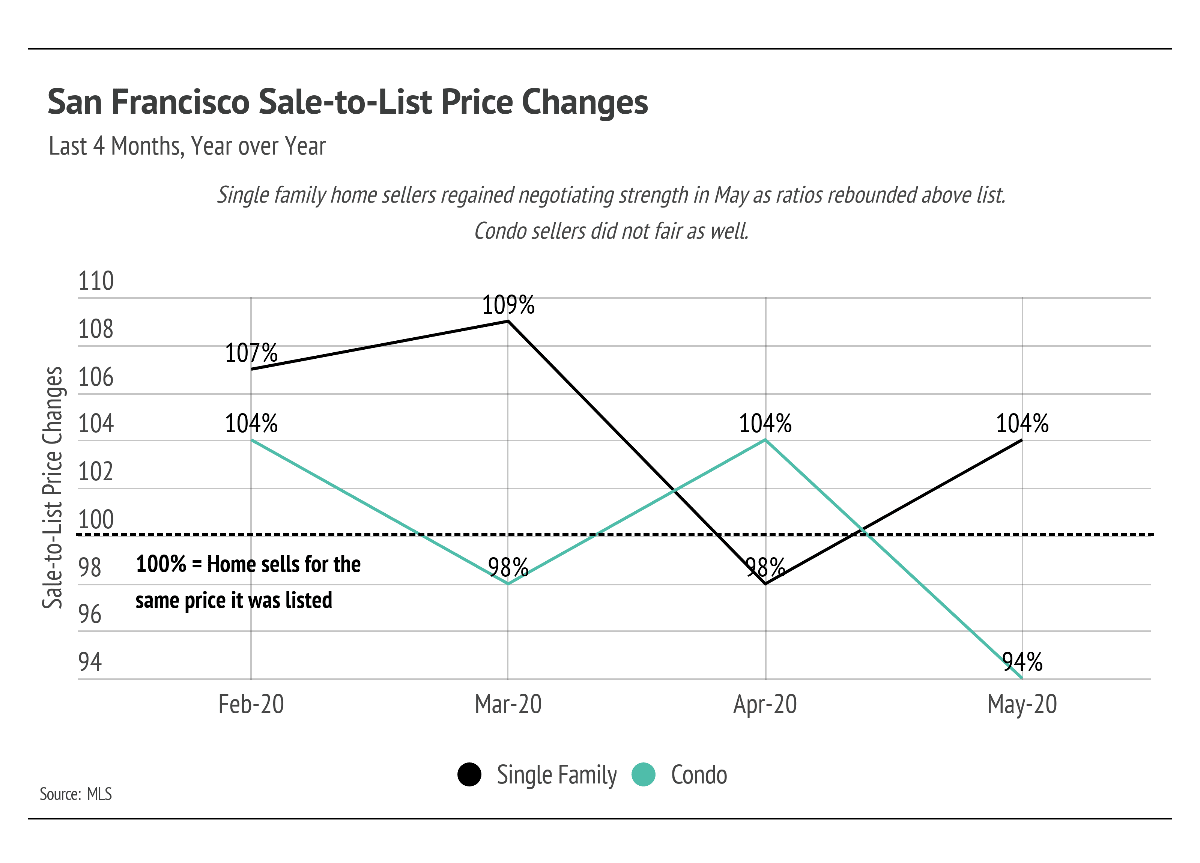

The sale-to-list ratio reflects the change in the original list price and the final sale price of a home. For example, a ratio of 100% means that a home sold for the price at which it was most recently listed. In San Francisco, single-family homes almost always have higher sale-to-list ratios than condos. Single-family-home prices sold at a premium in May, rebounding from April when homes sold below list price for the first time in over a year.

Here, the condo market diverges again. In addition to the rise in price cuts, condos sold at their largest discount in over two years. One reason the markets differ may be because condos cater to a younger and more mobile population with smaller households. For a population whose choice of residence is governed primarily by their employer, the recent shake up might make San Francisco’s high living standards less appealing, or no longer necessary, thereby prompting a small exodus.

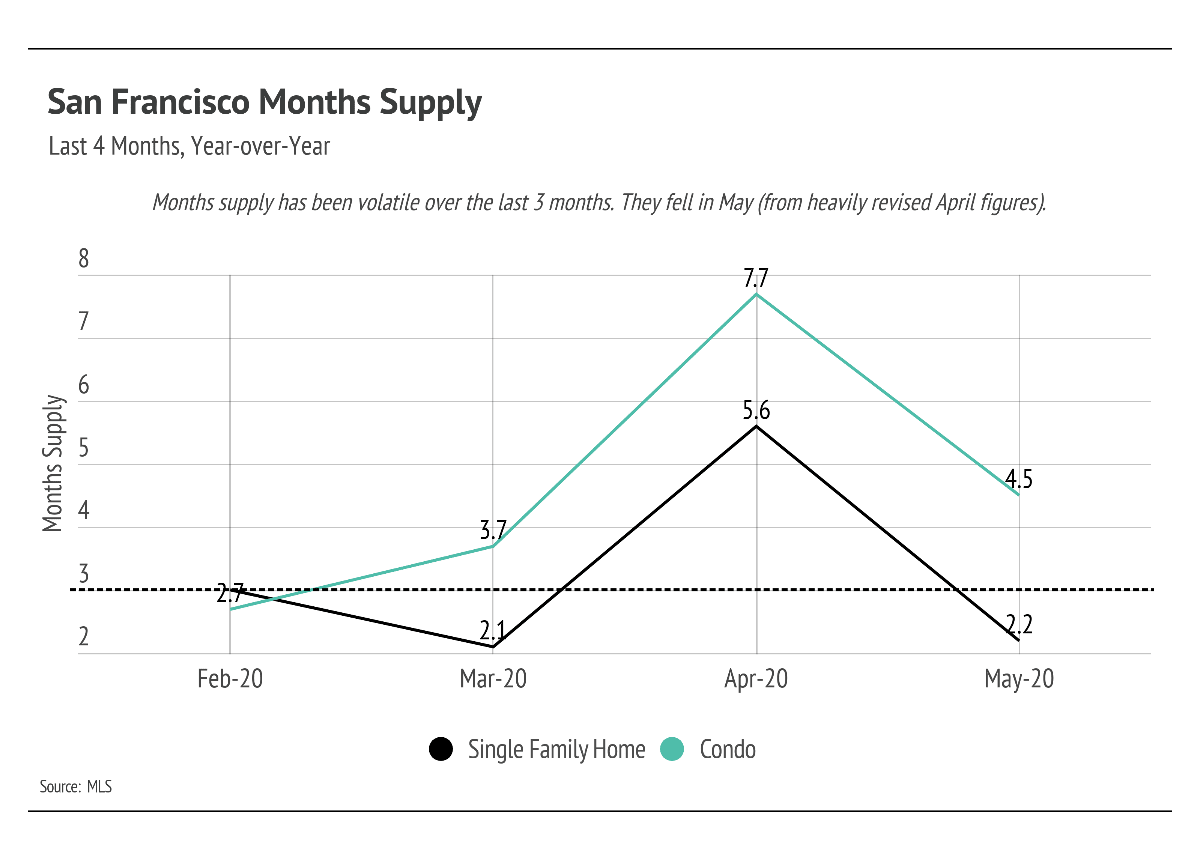

Lastly, we look at months supply of inventory, which measures how many months it would take for all current listings on the market (including listings under contract) to sell at the current rate of sales. In California’s high-demand market, a balanced supply level is three months, which means there are three months of housing inventory on the market at the current rate of sales. A market with less than three months supply of inventory favors sellers. In May, the months supply for single-family homes fell, following a big spike in April. It is now back down to the level we saw before the pandemic, which will help to further support home prices.

The months supply of inventory for condos also fell from April highs but settled well above the three-month level of supply. At 4.5 months, supply levels are now higher than normal, indicating that supply is outpacing demand.

As we discussed in previous newsletters, the fundamentals of the housing market were strong before the global economy stalled, and they have continued to show stability during the months of quarantine.

Looking ahead to July, we anticipate housing market activity to increase as pent-up demand turns into participation from both sides. We will closely monitor the divergence in single-family home and condo prices to make sure that our clients are pricing and negotiating to get the most value out of their transactions.

As always, we remain committed to helping our clients achieve their current and future real estate goals. Our team of experienced professionals would be happy to discuss the information we’ve shared in this newsletter. We welcome you to contact us with any questions about the current market or to request an evaluation of your home or condo.

Stay up to date on the latest real estate trends.

Michelle Kim | February 24, 2026

Exploring Daly City housing trends, lifestyle benefits, and what makes this Bay Area community a practical choice for buyers.

February 6, 2026

A closer look at Pacific Heights real estate, lifestyle, and buyer considerations for the year ahead

Michelle Kim | February 1, 2026

Quick Take: As interest rates continue to fall, median monthly P&I payments do as well, making housing slowly but surely more affordable on a national scale. Mortgage … Read more

Michelle Kim | February 1, 2026

Quick Take: Median sale prices continued their upward trajectory in December, with single-family homes gaining 8.63% year-over-year. Inventory levels have plummeted to… Read more

Michelle Kim | February 1, 2026

Quick Take: Single-family home prices held relatively steady in December, while the condo market continued its year-long slide with double-digit declines in Alameda Co… Read more

Michelle Kim | February 1, 2026

Quick Take: Single-family median sale prices rebounded across most of Silicon Valley in December, with San Mateo County posting nearly 10% year-over-year gains. Invent… Read more

You’ve got questions and we can’t wait to answer them.