Greater Bay Area Real Estate Market Report: May 2022

robyn May 1, 2022

robyn May 1, 2022

Quick Take:

Note: You can find the charts & graphs for the Big Story at the end of the following section.

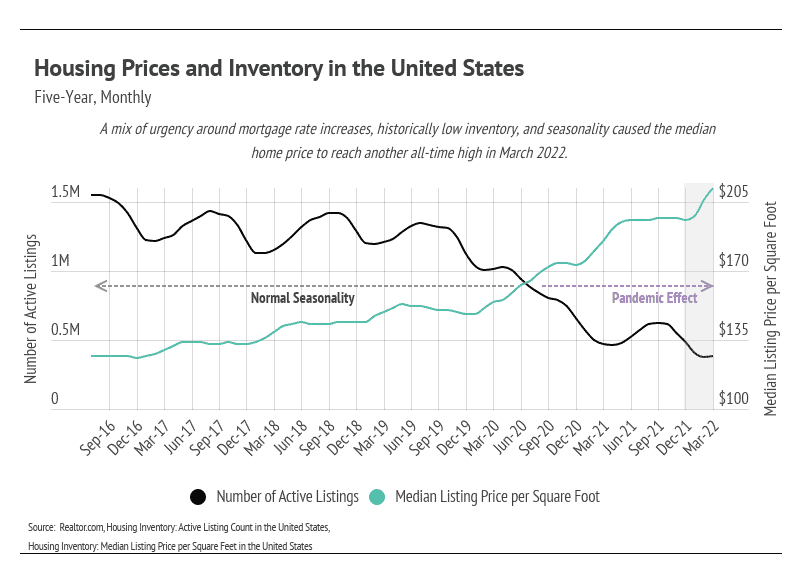

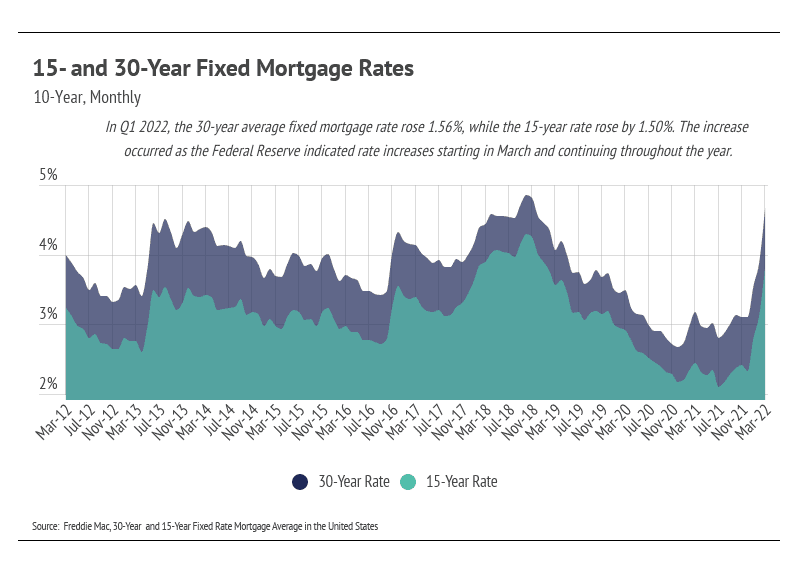

Mortgage rates rose faster than expected in the first quarter of 2022, already surpassing forecasts for the year. The 30-year average mortgage rate rose swiftly in the two weeks after the Fed’s March meeting, up 0.5% between March 17 and 31 to 4.67%. This rapid increase has spurred purchases as buyers try to lock in lower rates before they climb higher. The data reflect the urgency buyers face. Nationally, home prices have reached yet another milestone: hitting above $200 per square foot, the highest level in history. But is the urgency justified? The answer is 100% yes, assuming you find the right home for you. Let’s dig into the numbers a little.

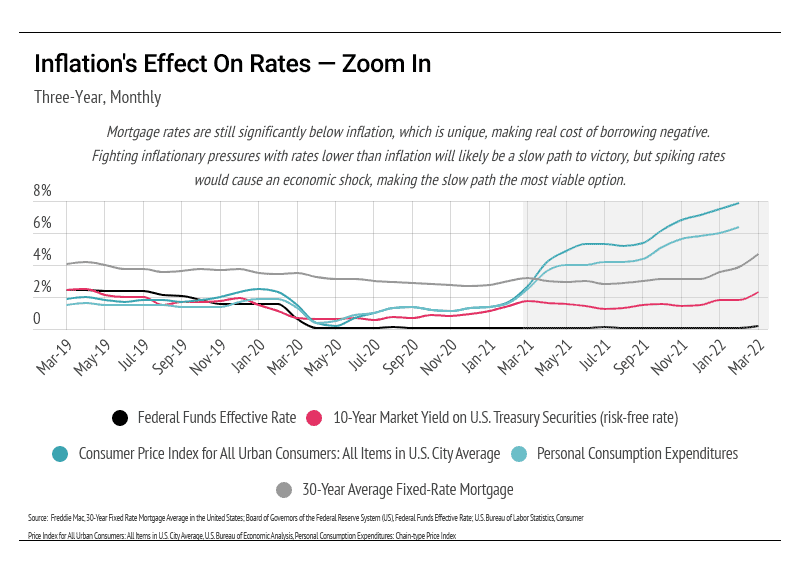

The average 30-year mortgage rate was 3.11% in December 2021, rising to 4.67% by the end of Q1 2022. If you bought a home in December and financed it with a $500,000 mortgage loan at 3.11%, your monthly spend on principal and interest would be $2,138 — versus $2,584 if you got the same loan in March 2022 at 4.67%. Over the life of the loan, you’ll spend $160,560 more at 4.67%. In short, every percentage point matters significantly. As an aside, refinancing has decreased 60% below last year’s levels, according to the Mortgage Brokers Association. Economists and real estate experts seem torn between rates peaking just below or just above 5%. Because the Fed indicated the path of rate hikes for the rest of the year, mortgage rates increased in anticipation and are likely to be affected less when the Fed moves the federal funds rate in the future, if it sticks to its schedule. At this point, we can almost guarantee that rates will not decline substantially this year.

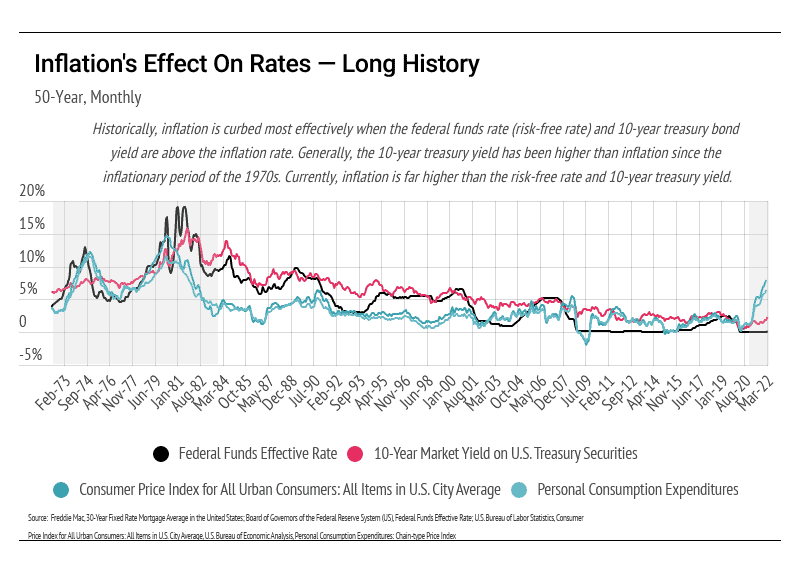

As we look at historical trends in inflation, we are curious about how effective the Fed’s rate hikes will be. Rates rose significantly in the 1970s, partially due to the inflation rate at the time. Mortgage rates peaked at over 18%, which is unimaginable today. As we look at the long-term data, we see that inflation tends to decline when the federal funds rate is above the inflation level. Currently, the federal funds rate is far below inflation, and the Fed doesn’t plan to lift it near the inflation level because of the economic shock that would ensue. The current cost to borrow is actually negative, which may incentivize more people to borrow and spend more in the short term, driving inflation higher. At current mortgage and inflation levels, the borrower, not the lender, gains around 3% from borrowing.

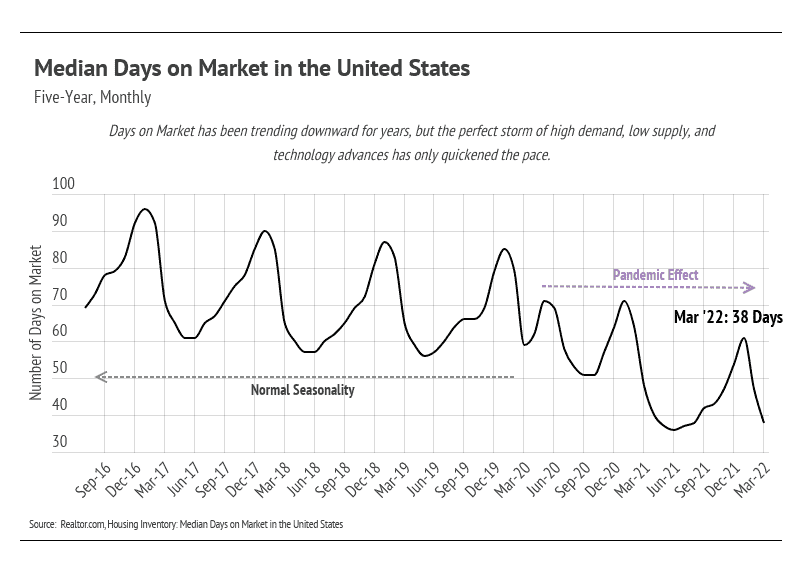

In addition to rising rates, supply still drives home prices. In March, the housing supply ticked up ever so slightly from the all-time low in February. We are entering the spring buying season, however, with the lowest inventory on record. From March 2020 to March 2022, the housing supply declined 62%. Over the past three months, which had the lowest inventory on record, home prices increased nearly 10%. Rising rates, in the short term, boost demand because potential homebuyers want to get ahead of the increase, but in the long term, they reduce demand. Because the market is so undersupplied, less demand is actually a good thing. Home prices simply cannot maintain the rapid increases. Although a housing bubble isn’t likely yet, a sustainable growth rate is better and safer for the long term.

Quick Take:

Note: You can find the charts/graphs for the Local Lowdown at the end of this section.

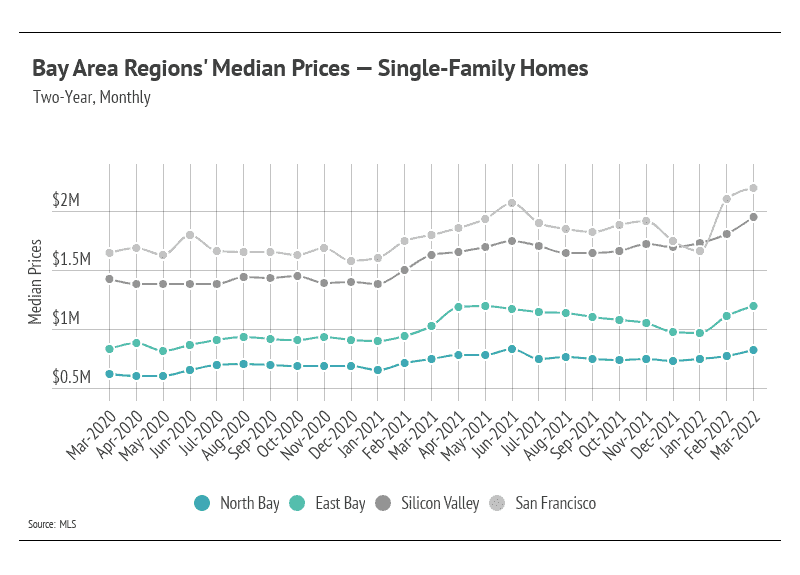

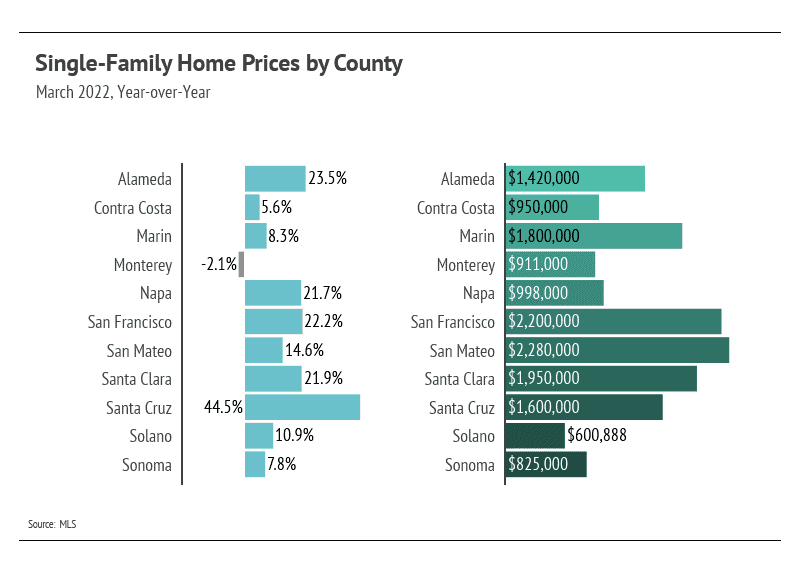

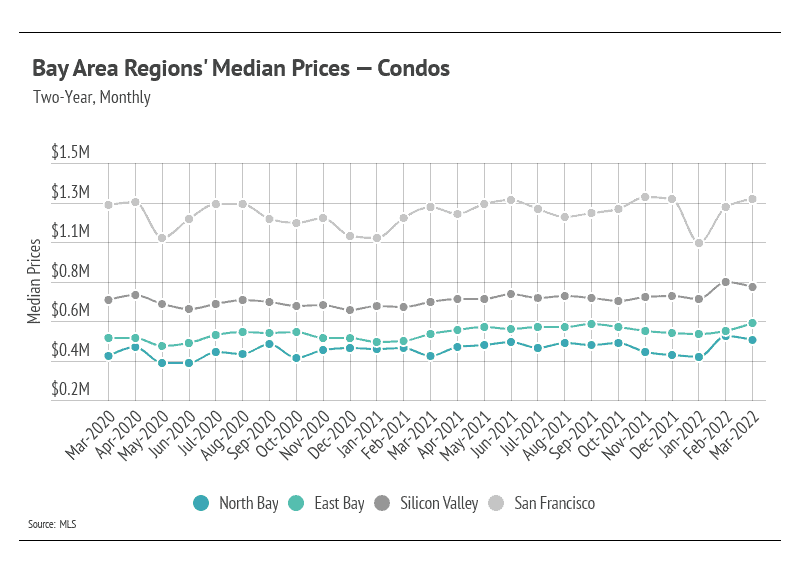

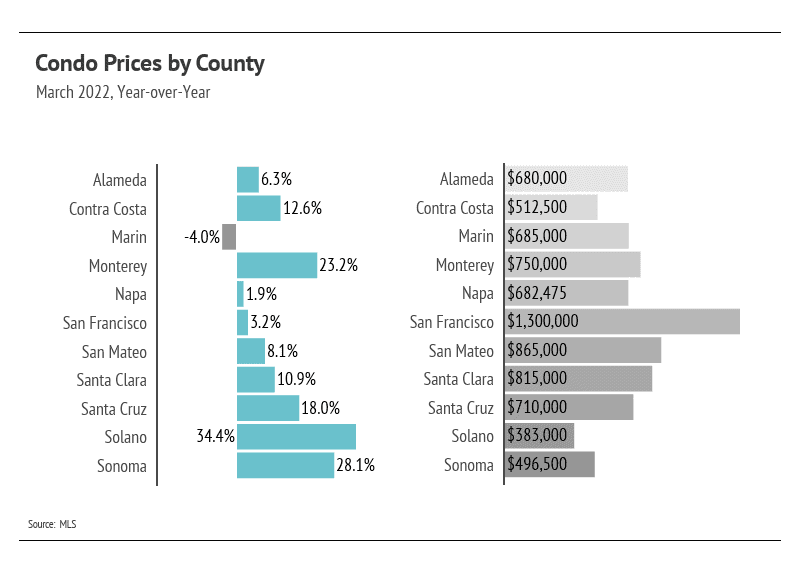

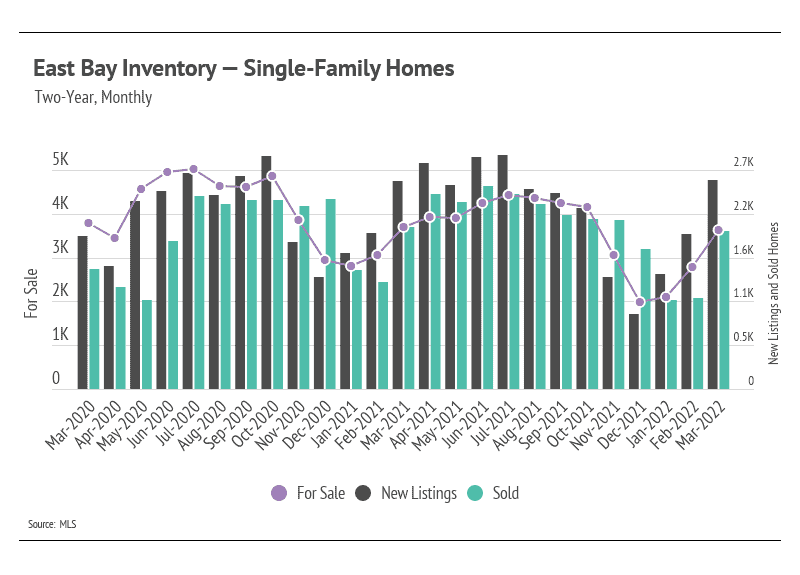

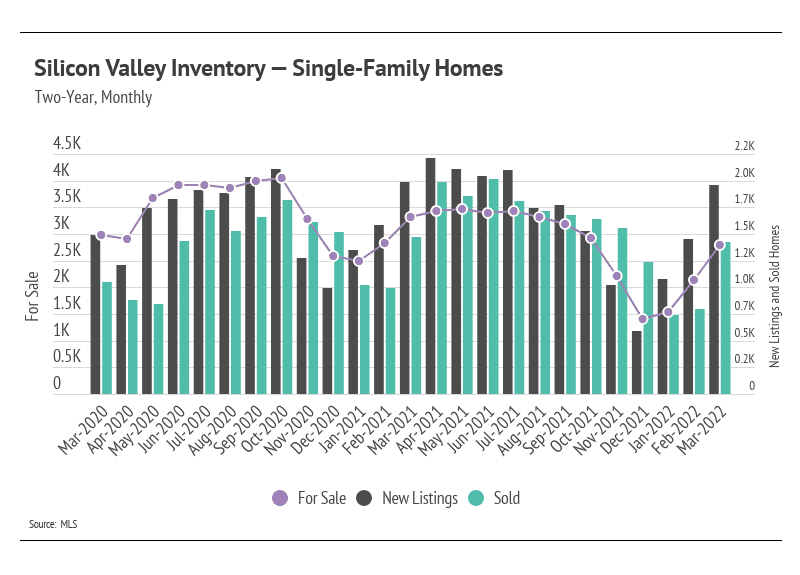

Single-family home prices rose to all-time highs in the East Bay, Silicon Valley, and San Francisco, while North Bay prices are just under their peak. East Bay condo prices also reached an all-time high in March 2022. Because sales often have a one-month lag, with homes going under contract around a month before the sale is complete, we cannot yet determine how significantly increasing rates have hit the market. Mortgage rate hikes really only lower demand in the long term, but in the short term, demand increases as buyers try to lock in a lower rate. The Greater Bay Area housing market has a major advantage in that high demand is constant. Despite the huge increases in home prices over the past 12 months, the lack of housing supply will keep prices rising in the coming months.

The Fed is expected to raise interest rates by 0.25% at least six times this year, going from 0% to 1.90%. We are now entering a period where factors that affect prices are more mixed, unlike the past two years when all the factors caused prices to increase. Rising interest rates, which will hopefully curb the still-rising, 40-year-high inflation rate, will make homes less affordable and dampen demand over the course of the year. But inventory is so low that even with less demand, the market will likely remain undersupplied. It might seem counterintuitive that home prices can still appreciate after increasing so much over the past two years, but with inventory at record lows, home prices in 2022 will still increase — though at a slower rate than in 2021. With high sales relative to the available inventory, we anticipate a competitive market in the year ahead.

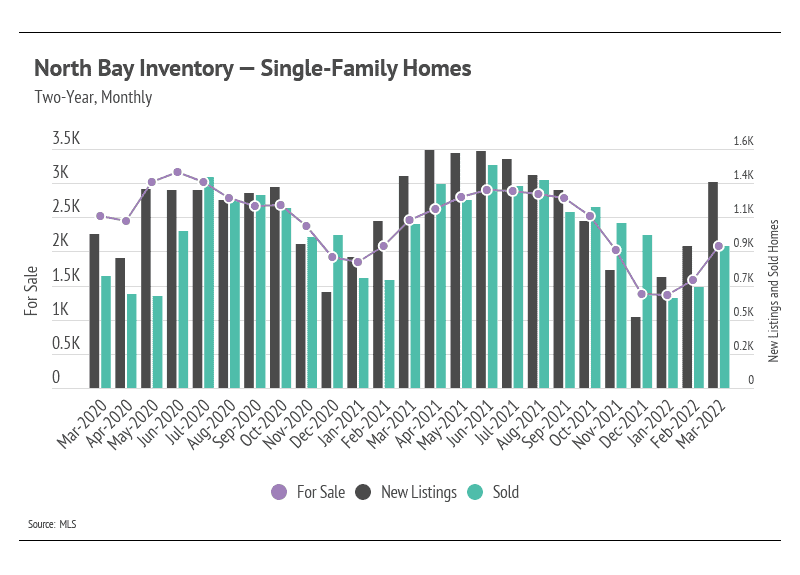

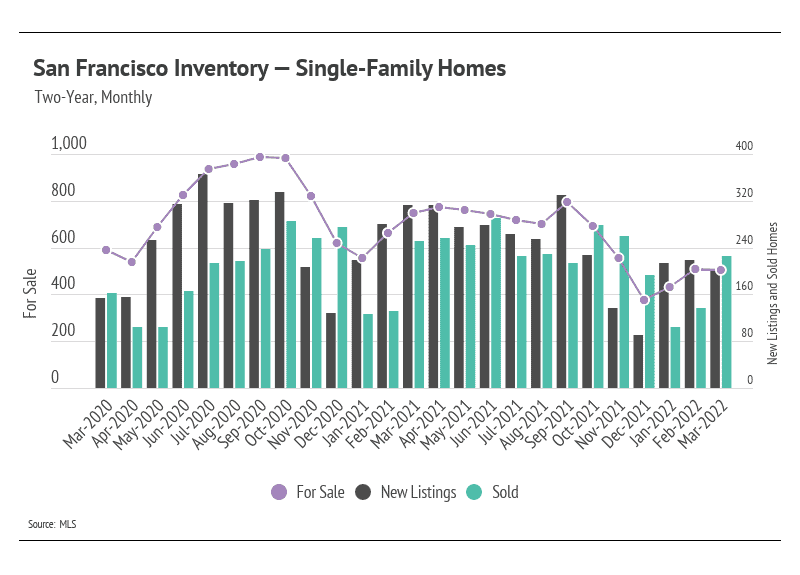

The Greater Bay Area, like the rest of the country, has a historically low housing inventory. The sustained high demand and lack of new listings over the past year brought single-family home and condo supplies to record lows across markets. Although the first quarter of 2022 had the lowest inventory on record, we are pleased to see that inventory is increasing. If this upward trend continues into the second quarter, that will be a large indicator that the housing market is normalizing.

Sales have still been incredibly high, especially when accounting for available supply, again highlighting demand in the area. Sellers can expect multiple offers, and buyers should come with competitive offers. The incredibly high demand we’ve seen over the past year might wane as interest rates increase; however, the supply is so low that the market can handle a drop in demand without negatively affecting prices. The 30-year average fixed-rate mortgage hasn’t climbed above 5% yet, but it almost certainly will. If mortgage rates reach 5%, demand will likely decline more substantially. In the next few months, demand will remain high relative to available supply.

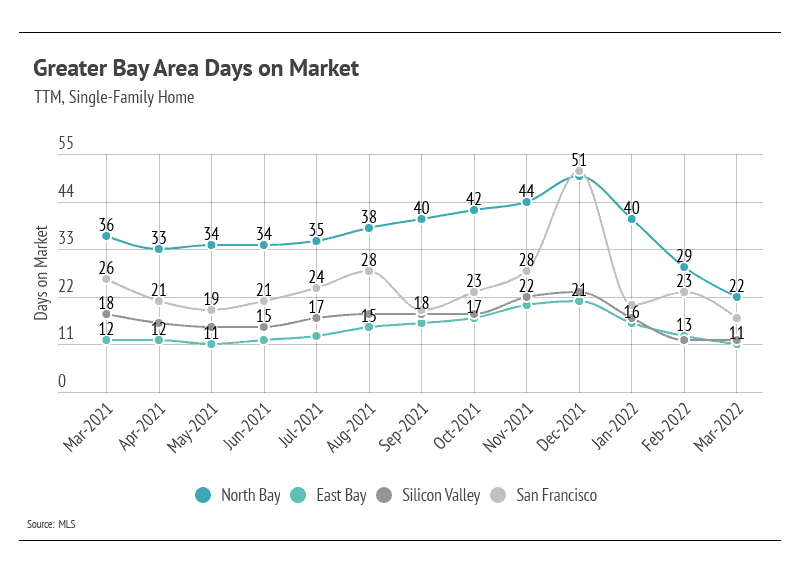

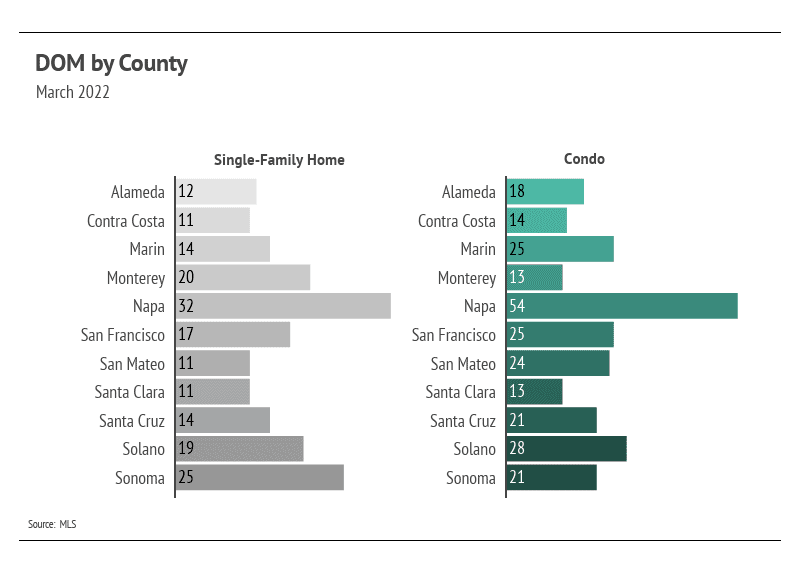

Homes are still selling extremely quickly. The Days on Market reflects the high demand for homes in the Greater Bay Area. Buyers must put in competitive offers above the list price of the home.

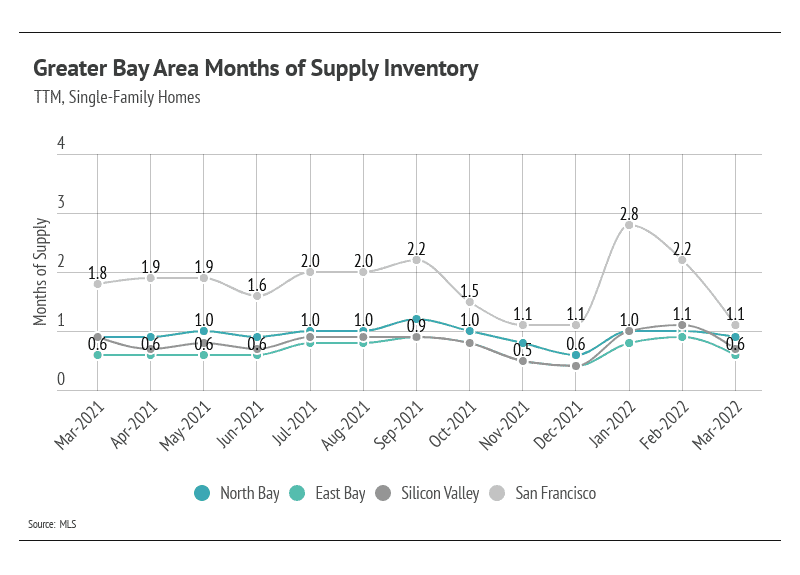

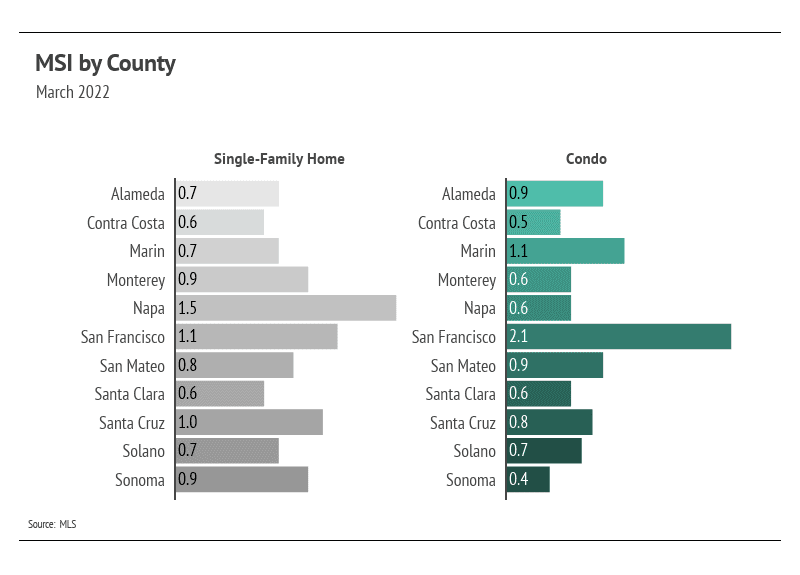

Months of Supply Inventory (MSI) quantifies the supply/demand relationship by measuring how many months it would take for all current homes for sale on the market to sell at the current rate of sales. The average MSI is three months in California, which indicates a balanced market. An MSI lower than that indicates that there are more buyers than sellers on the market (meaning it’s a sellers’ market), while a higher MSI indicates there are more sellers than buyers (meaning it’s a buyers’ market). Currently, single-family home and condo MSIs are exceptionally low, indicating a strong sellers’ market.

Stay up to date on the latest real estate trends.

You’ve got questions and we can’t wait to answer them.