San Francisco Real Estate Market Report: January 2022

robyn January 3, 2022

robyn January 3, 2022

Quick Take:

Note: You can find the charts & graphs for the Big Story at the end of the following section.

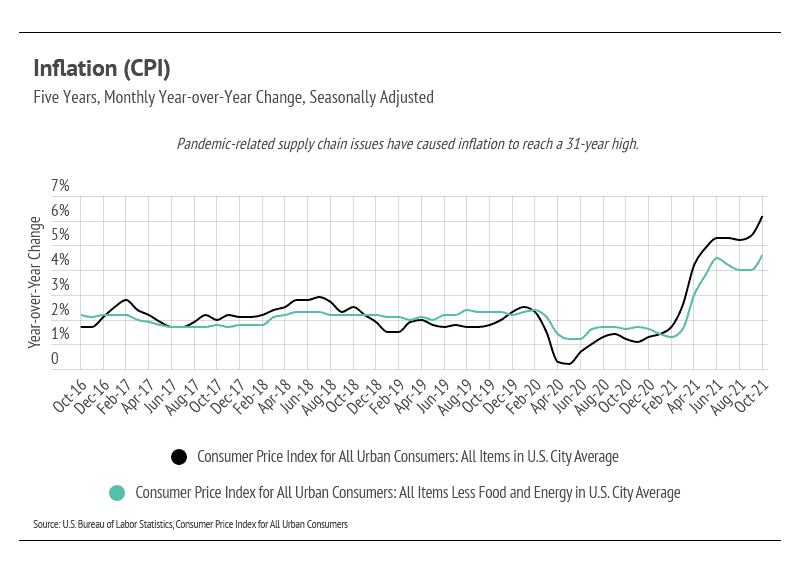

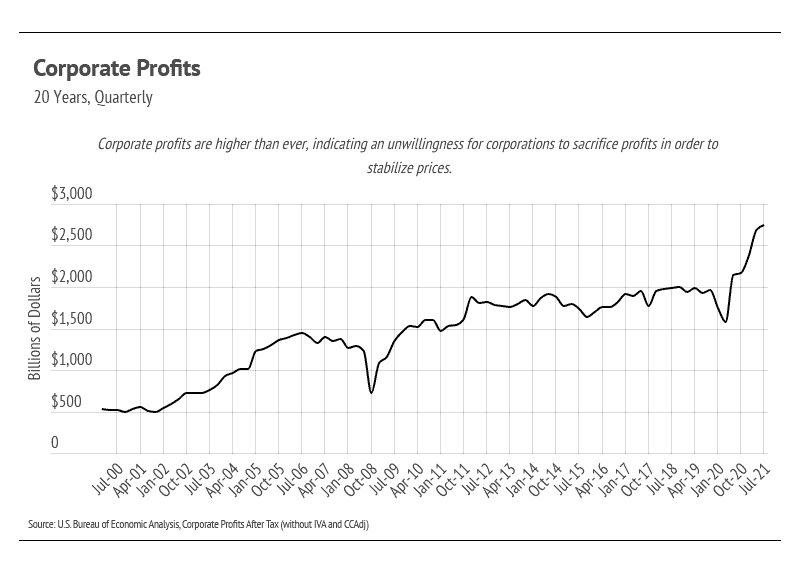

By now, you’ve likely run across a headline regarding the large inflation jump we’ve experienced over the past six months. Even if you haven’t, you’ve probably noticed a general increase in prices for things like gas and food over the past couple of months. The last significant long-term inflationary period was in the 1970s when inflation expectations created a feedback loop largely because unions were common and had more bargaining power. As prices rose, union workers demanded higher pay, which increased operating costs and fueled rising prices. But 2020-21 is quite different from the 1970s. Currently, companies are using inflation as a mostly bad-faith excuse to raise prices during a time of record corporate profits, which will benefit companies as consumers bear the burden of rising costs. This is likely the unfortunate feedback loop we will see during the next six months. All that to say, as consumer costs rise, we might see demand for housing decline. With fewer experiences to spend money on during the pandemic, savings shot up, allowing potential homebuyers to reach their down payment goals far more quickly than expected. Inflation will cut into our ability to save.

Unlike a normal business cycle, the pandemic is still disrupting the global supply chain, with fewer dock/port workers and truck drivers as well as continued international travel restrictions. This is compounded by the pandemic-related shifts in consumer preferences: consumers are choosing physical goods rather than services. The demand for physical goods isn’t unique to the U.S., either — the whole world is trying to recover economically with a move toward physical goods, which is stressing the supply chain. The good news, however, is that inflation will likely fall around summer 2022 and shouldn’t mimic the decade-long inflationary period of the 1970s. The bad news is that it isn’t coming down today.

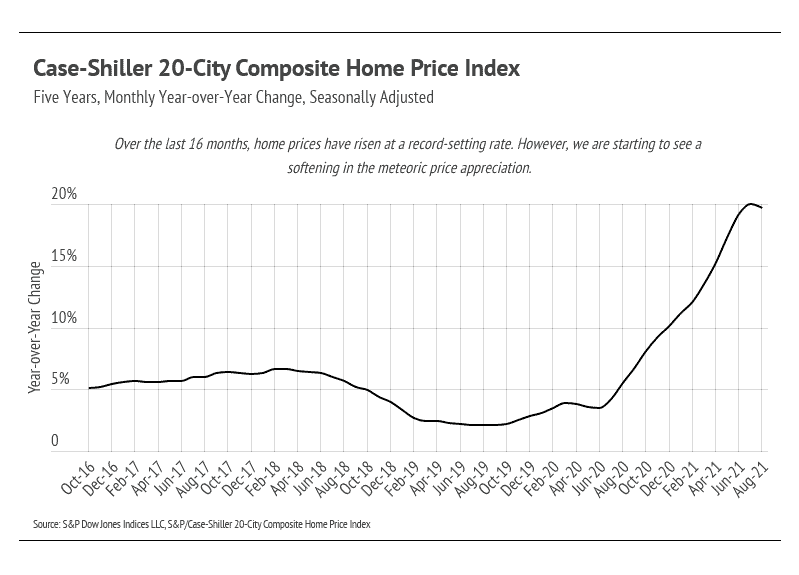

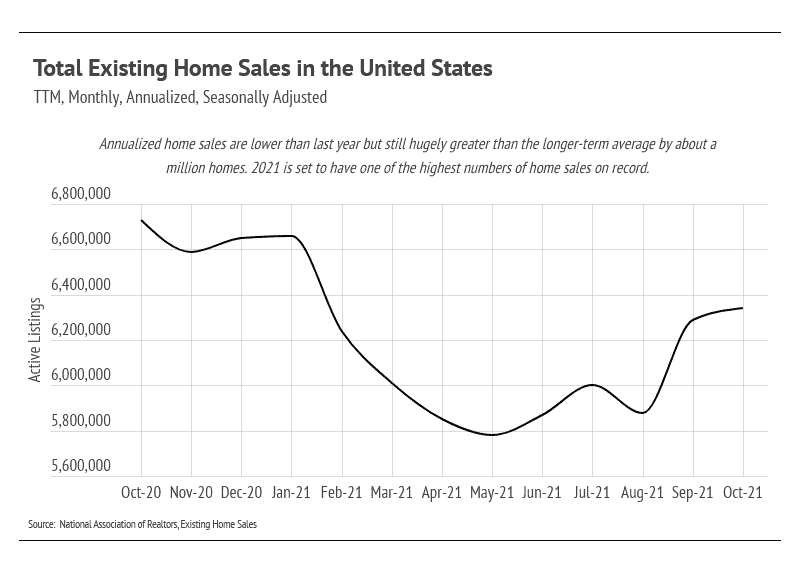

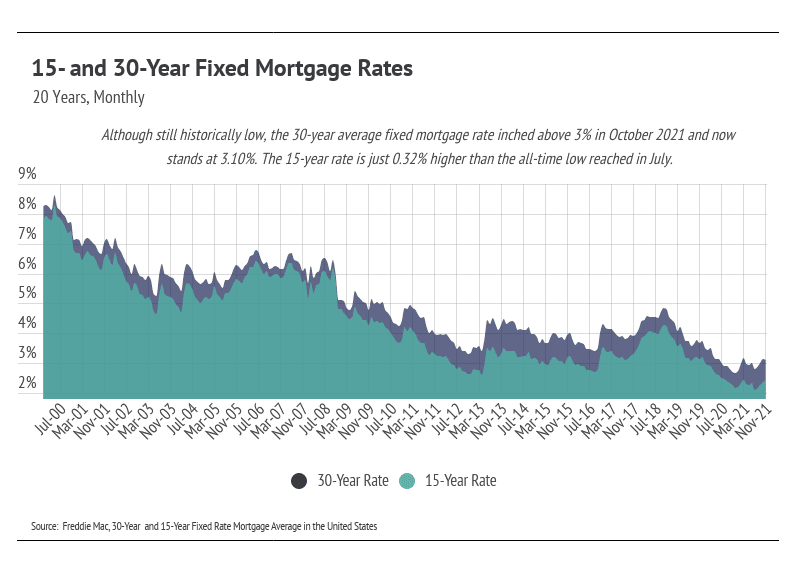

Although not necessarily a strict supply chain issue, the rising cost of housing can definitely be tied to supply. In the U.S., the supply of houses for sale is still near the all-time low reached in April. At the same time, demand remains high for homes, and we are on pace to have around a million more homes sold in 2021 than in a typical year, based on the long-term average. In other words, more homes are selling despite the historically low inventory. Because inflation diminishes the purchasing power of a dollar over time, buyers face pressure to buy sooner rather than later, further increasing demand for homes. Coupling inflation with historically low mortgage rates creates incentives to buy now even with the run-up in prices.

The market remains competitive for buyers, but conditions are making it an exceptional time for homeowners to sell. Low inventory means sellers will receive multiple offers with fewer concessions. Because sellers are often selling one home and buying another, it’s essential that sellers work with the right agent to ensure the transition goes smoothly.

Quick Take:

Note: You can find the charts/graphs for the Local Lowdown at the end of this section.

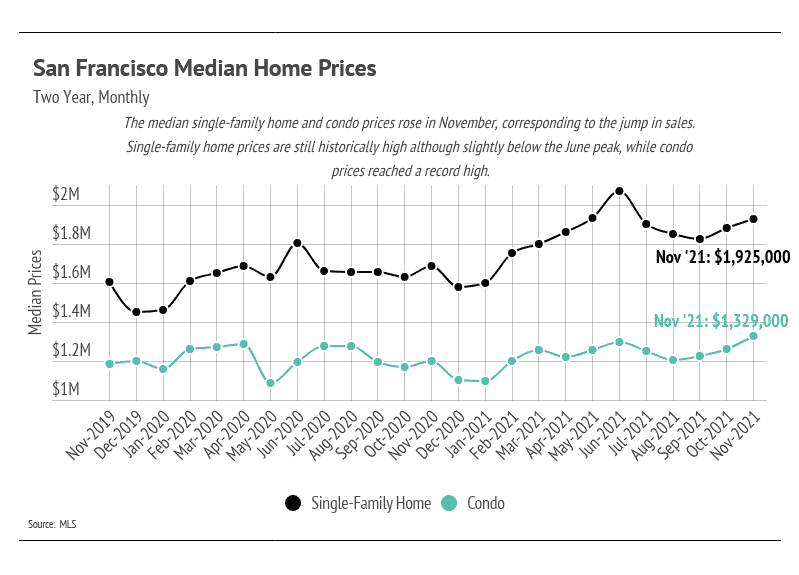

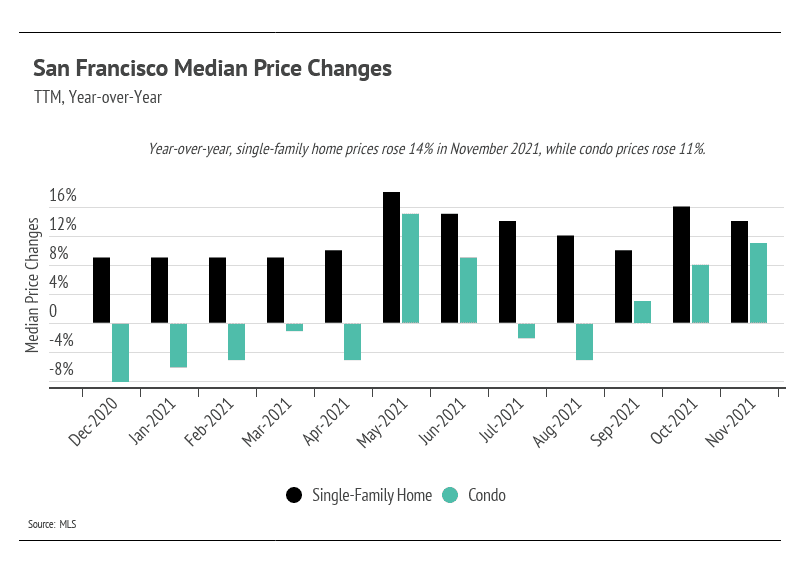

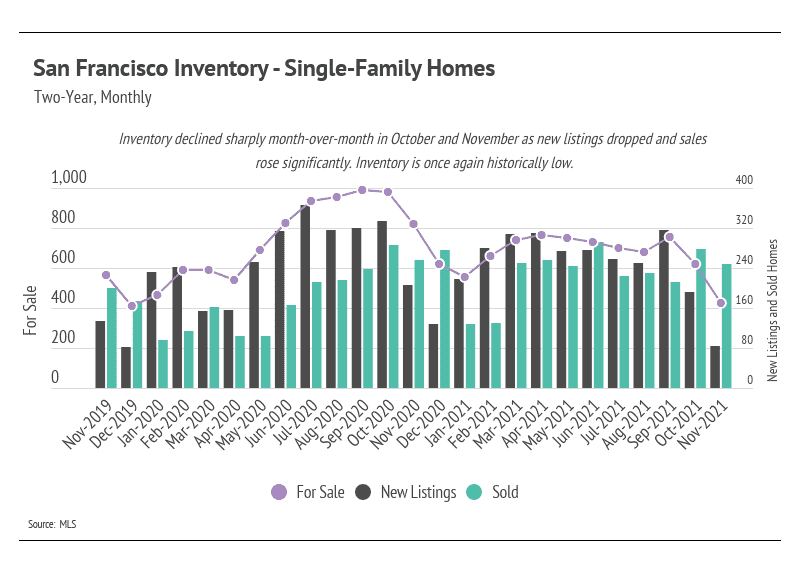

| After single-family home prices appreciated significantly in the first half of the year, it made sense that we would see a correction in the third quarter. Prices rebounded in the fourth quarter, moving higher but below peak levels. Sales jumped the past two months, causing prices to climb higher, just under peak. Condo prices, however, reached an all-time high in November. This is the first new high we’ve seen in over a year. The pandemic hit demand for condos hard, but price and sales indicate that demand is back. |

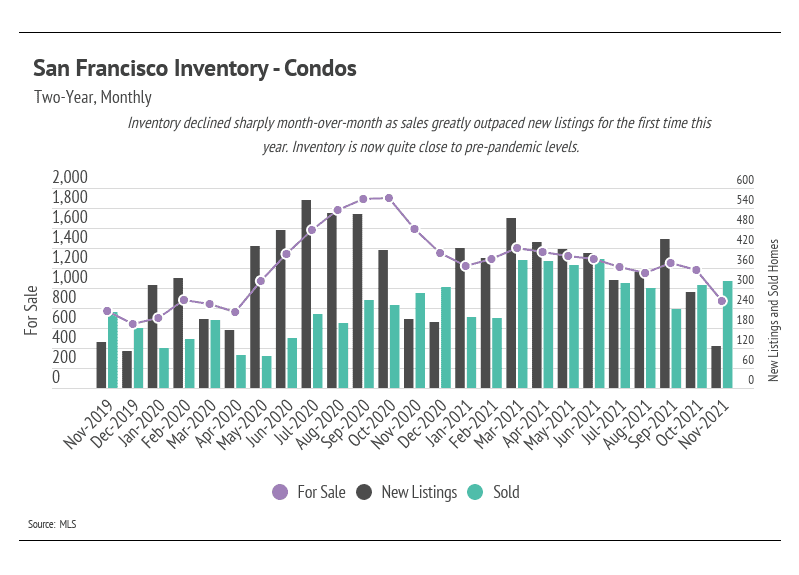

Despite the slight increase in single-family home and condo inventory in 2021, we’re still at a historic low. August and September are typically the months each year with the highest inventory. In 2021, total inventory didn’t come close to last year’s level. Even though we’re seeing some price correction after the first half of the year for single-family homes, the sustained low inventory will lift prices. Sales in San Francisco have been incredibly high, again highlighting demand in the area.

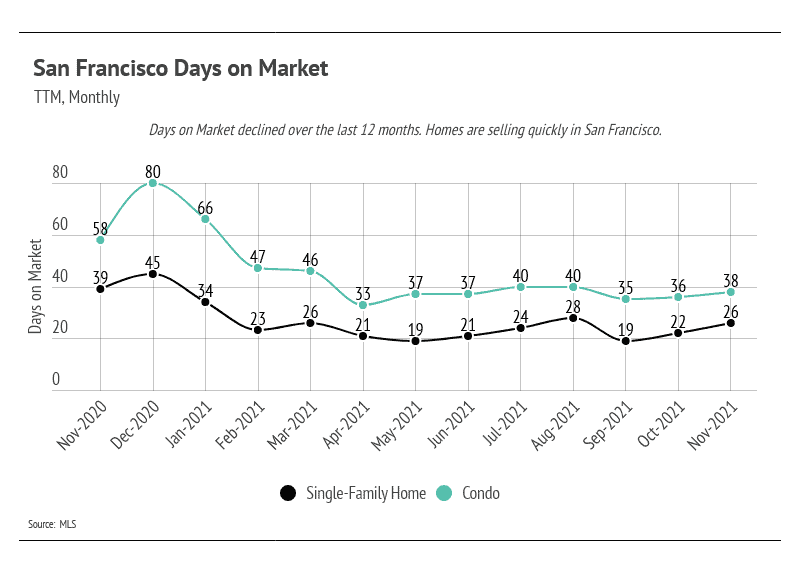

Homes are selling faster than at any point in the past 15 years. The Days on Market reflects the high demand for homes in San Francisco. Buyers must put in competitive offers, which, on average, are 16% above the list price for single-family homes and 4% above for condos.

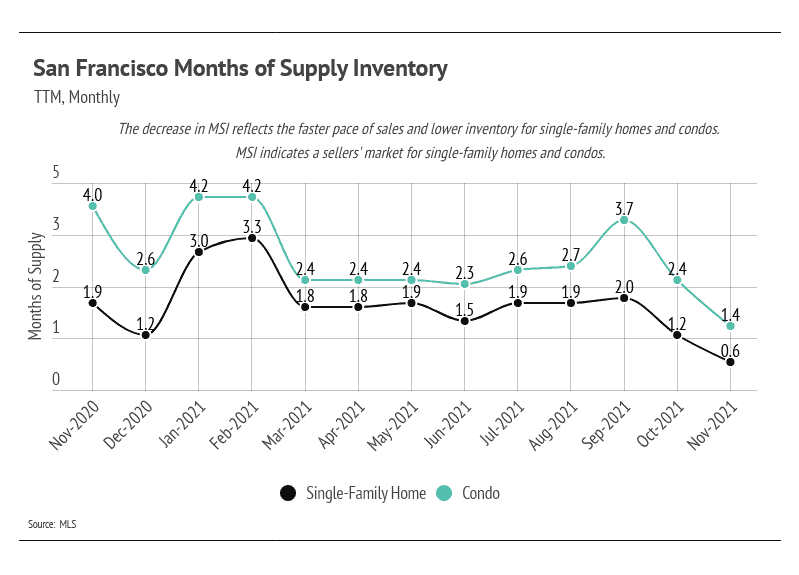

Months of Supply Inventory (MSI) quantifies the supply/demand relationship by measuring how many months it would take for all current homes for sale on the market to sell at the current rate of sales. The average MSI is three months in California, which indicates a balanced market. An MSI lower than three indicates that there are more buyers than sellers on the market (meaning it’s a sellers’ market), while a higher MSI indicates there are more sellers than buyers (meaning it’s a buyers’ market). Currently, single-family home and condo MSIs are both low, indicating a sellers’ market.

Stay up to date on the latest real estate trends.

Michelle Kim | February 24, 2026

Exploring Daly City housing trends, lifestyle benefits, and what makes this Bay Area community a practical choice for buyers.

February 6, 2026

A closer look at Pacific Heights real estate, lifestyle, and buyer considerations for the year ahead

Michelle Kim | February 1, 2026

Quick Take: As interest rates continue to fall, median monthly P&I payments do as well, making housing slowly but surely more affordable on a national scale. Mortgage … Read more

Michelle Kim | February 1, 2026

Quick Take: Median sale prices continued their upward trajectory in December, with single-family homes gaining 8.63% year-over-year. Inventory levels have plummeted to… Read more

Michelle Kim | February 1, 2026

Quick Take: Single-family home prices held relatively steady in December, while the condo market continued its year-long slide with double-digit declines in Alameda Co… Read more

Michelle Kim | February 1, 2026

Quick Take: Single-family median sale prices rebounded across most of Silicon Valley in December, with San Mateo County posting nearly 10% year-over-year gains. Invent… Read more

You’ve got questions and we can’t wait to answer them.