The information provided is intended to provide general information about Proposition 19. It is not intended to be a legal interpretation or official guidance, or relied upon for any purpose, but is instead a presentation of summary information. Proposition 19 is a constitutional amendment, so additional legislation, regulations, and statewide guidance are expected to clarify its implementation. If there is a conflict between the information provided here and the proposition or any legal authorities implementing or interpreting the proposition, the text of the proposition and the other implementing or interpretive authorities will prevail. We encourage you to consult an attorney for advice on your specific situation.

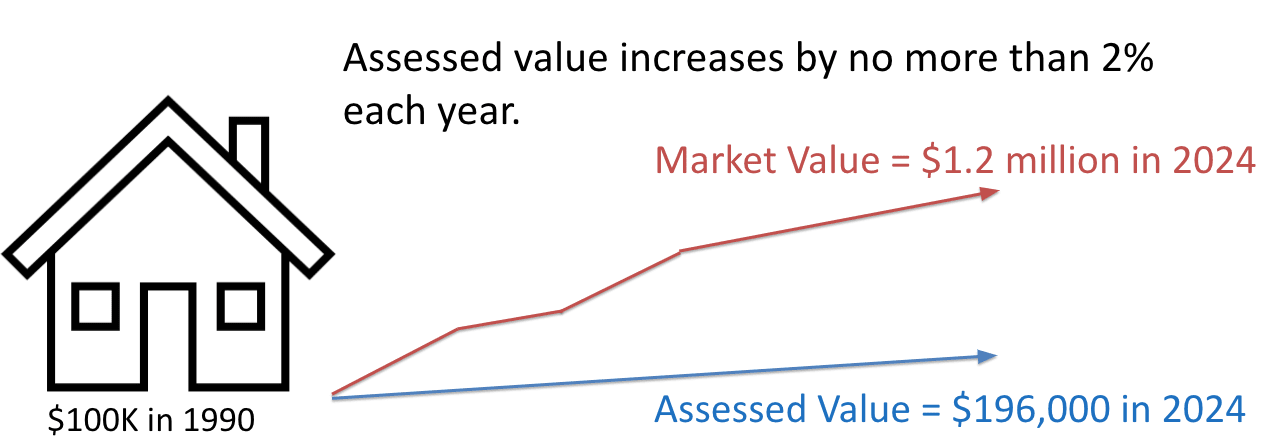

Assessed Value is fair market value at the time of change in ownership.

|

|

|

|

Rule: Excess market value is added to the FBYV

$300,000 (excess) + $250,000 (FBYV) = $550,000 New Base Year Value

Q: I am 54 years old. If I sell my home now and buy the replacement dwelling after I turn age 55, will I be eligible to transfer the base year value?

Answer: No. You must be age 55 or over when you sell your original primary residence to qualify. You may purchase a replacement residence prior to age 55, but you must be age 55 or older on the sale of the original primary residence.

Q: How long do I have to buy a replacement property after selling my original home?

Answer: You have two (2) years to purchase a replacement property that you will use as a primary residence.

Q: A couple divorces. As part of the divorce, their principal residence was sold. Would each of the owners be able to transfer their share of the base year value to their respective replacement residences?

Answer: No, only one claimant may transfer the original property's base year value. If both parties qualify, they must mutually decide who will get the benefit.

Q: Can I have my child on title with me?

Answer: Yes, if you and your child purchase the property together from a third party. There is no requirement that the claimant be the sole owner of either the original primary residence or the replacement primary residence.

| Type of Relief | Forms to File | Name of Form | Filing Deadlines |

|---|---|---|---|

| Age 55 or Older | BOE-19-B | Claim for Transfer of Base Year Value to Replacement Primary Residence for Persons at Least Age 55 Years | Within 3 years of the date a replacement dwelling is purchased, or new construction of a replacement dwelling is completed. |

| Severely and Permanently Disabled | BOE-19-D and BOE-19-DC | Claim for Transfer of Base Year Value to Replacement Primary Residence for Severely Disabled Persons, and Certificate of Disability | Within 3 years of the date a replacement dwelling is purchased, or new construction of a replacement dwelling is completed. |

| Victim of Wildfire or Natural Disaster | BOE-19-V | Claim for Transfer of Base Year Value to Replacement Primary Residence for Victims of Wildfire or Other Natural Disaster | Within 3 years of the date a replacement dwelling is purchased, or new construction of a replacement dwelling is completed. |

• Eligible for Homeowners' or Disabled Veterans' Exemption

- The claim form, BOE-266, Claim for Homeowners' Property Tax Exemption is available at www.sfassessor.org

Any excess market value is added to the FBYV.

| Type of Relief | Forms to File | Name of Form | Filing Deadlines |

|---|---|---|---|

| Family Home | BOE-261-G or BOE-266 | Claim for Disabled Veterans' Property Tax Exemption or Claim for Homeowners' Property Tax Exemption</td | Within 1 year from date of death or transfer. Exclusion will be applied prospectively if filed after 1-year period. |

| Family Home | BOE-19-P | Claim for Reassessment Exclusion for Transfer Between Parent and Child Occurring on or After February 16, 2021 | Within 3 years from date of death or transfer, or before transfer to 3rd party, whichever is earlier. |

| Date of Transfer or Change in Ownership | Applicable $1 Million Amount |

|---|---|

| February 16, 2021 – February 15, 2023 | $1,000,000 |

| February 16, 2023 – February 15, 2025 | $1,022,600 |

California Board of Equalization FAQs and Guidance

• www.boe.ca.gov/prop19/#Guidance

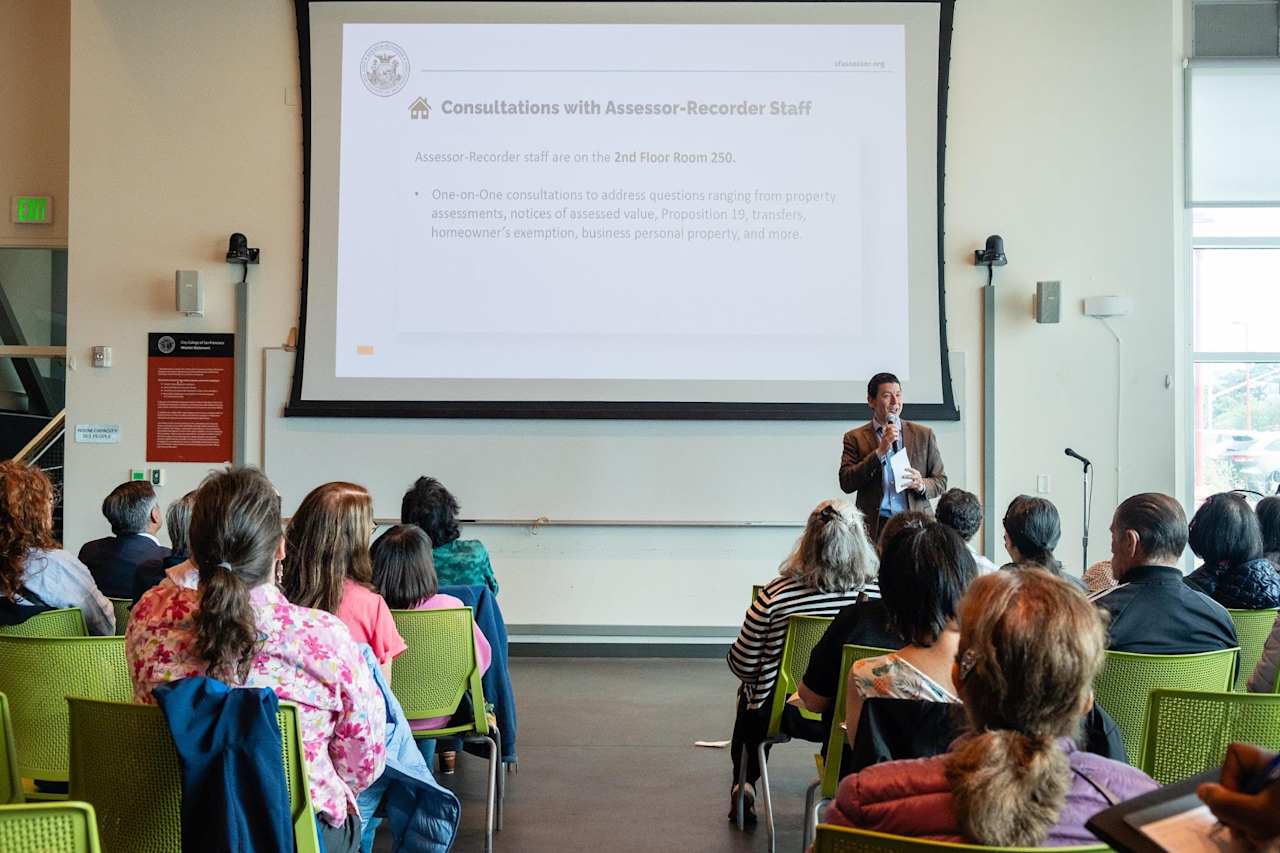

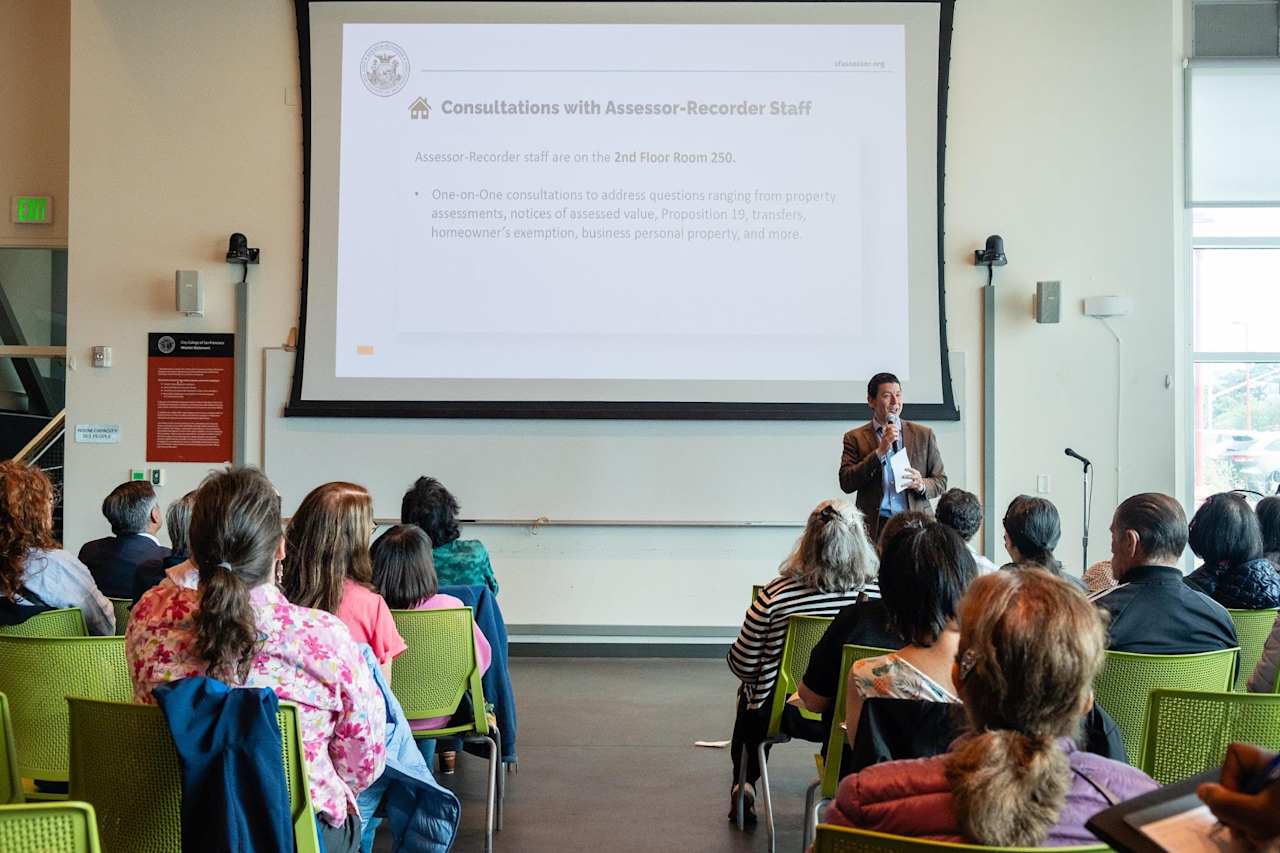

San Francisco Office of the Assessor-Recorder

You’ve got questions and we can’t wait to answer them.